A True and Factual Account of Fraud and Corruption

Bob Wigley - Chairman

Wigley's Self-Penned Introduction on his Website

"Robert Wigley backs young entrepreneurs in cutting edge technology businesses and Chairs UK Finance. He spent a career in finance rising to be EMEA Chairman of Merrill Lynch and a member of the board of the Bank of England during the 2008 financial crisis. He has been Chairman of the Green Investment Bank Commission and wrote the seminal report Winning in the Decade Ahead on the future of London as a Global Financial Centre, for Boris Johnson when he was Mayor of London. He is Fellow of the Institute of Chartered Accountants and Companion of the Chartered Management Institute. He is an Adjunct Professor at the University of Queensland, a Visiting Fellow of Oxford University’s Said Business School and an Honorary Fellow of Cambridge University’s Judge Business School. He sits on the UK’s Economic Crime Strategic Board which is Co-Chaired by the Chancellor and the Home Secretary. He is an Officer of the Order of St John. "

Wigley's biography has one striking omission. His stewardship of a FTSE listed iconic British brand that he was Chairman of for half a decade. Why no mention of your time at Yell/Hibu Bob?, is it something you would rather forget? Many of Wigley's public facing website contributions conveniently airbrush his history at Yell/Hibu.

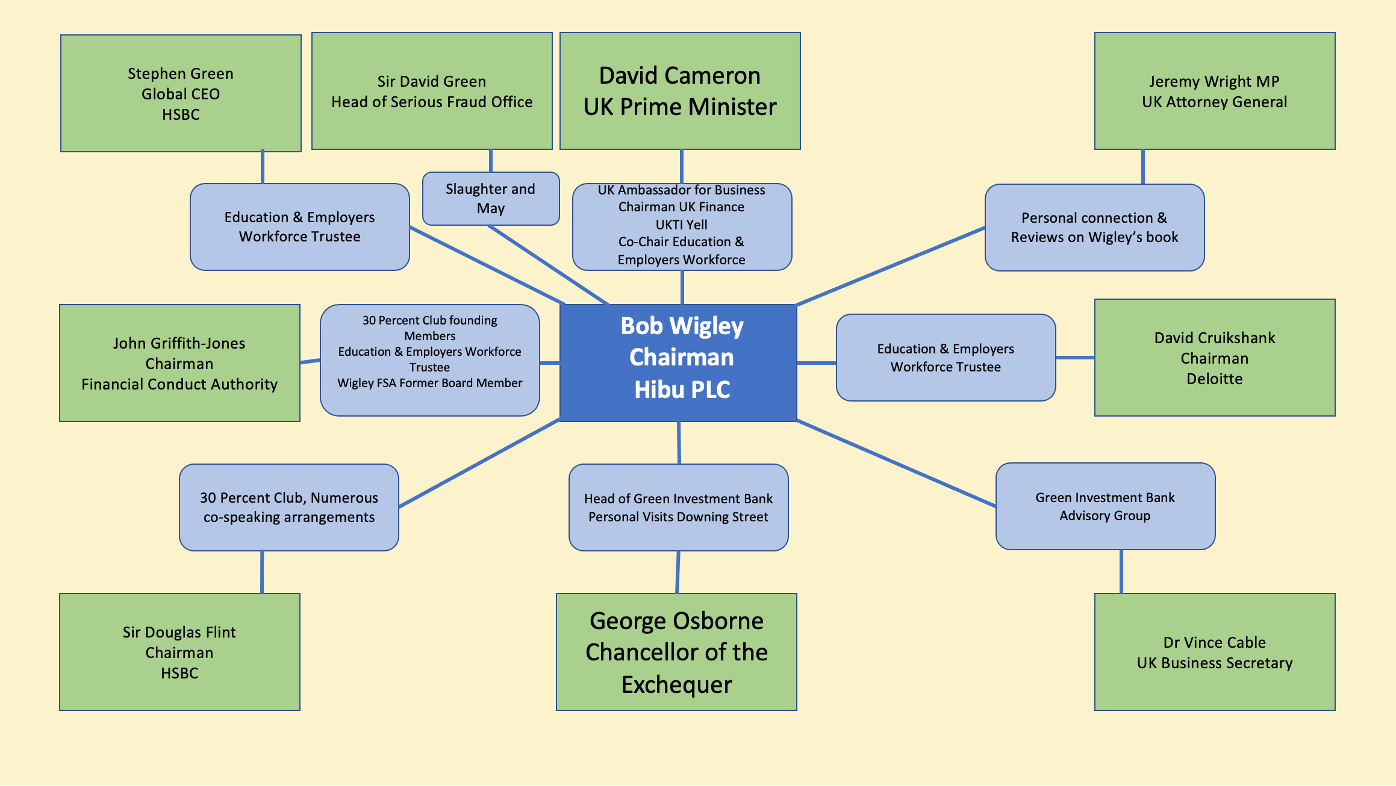

Described by The Telegraph as "Britain's Best Connected Businessman" Wigley certainly mixes with the right people in the financial and political world. Moreover, Wigley has connections at the top with all the relevant Government Bodies and Authorities that our group tried to obtain assistance from over the years. Given the rejections we were given by all of these authorities, despite the independent and professional corroboration of our evidence, we are sure even the most hardened sceptic could forgive us in our suspicions that something, somewhere, is not quite how it should be.

Let's look at some of Wigley's contacts and how we believe we did not receive the justice we deserved because of these connections.

David Cameron - UK Prime Minister

Wigley was appointed an "ambassador for UK Business" by David Cameron, the UK Prime Minister, in 2011. Quite an accolade for the "UK's Best Connected Businessman". Cameron led a trade party visit to India in 2010 where he was accompanied by the Chancellor of the Exchequer, George Osbourne, and Bob Wigley among others. Just a year after, "Call me Dave" was singing the praises of Yell PLC and Wigley Speaking at the UKTI event "SMEs Exporting and Growth" in central London where he said;

"UKTI is working with Yell to develop an online service called Open to Export which will provide SMEs with access to more information, advice and support from intermediary organisations like many of you here today."

Less than two years later, 7850 Yell shareholders had their shares made worthless by Wigley's tactics, and just a year after that, almost 4000 people had lost their jobs at Yell/Hibu.

Wigley never mentions that..

George Osborne - UK Chancellor of the Exchequer

In 2013 Chancellor of the Exchequer George Osborne authorised the creation of a Green Investment Bank and gave this new "bank" £3 billion of taxpayers money to fund its growth. The head of the Green Investment Bank Commission in charge of setting this up for the Chancellor was no other than Bob Wigley. So, Wigley was just as close to Number 11 Downing Street as he was Number 10.

Interestingly, the day after the EGM, in which Wigley and every other executive and non-executive of Yell/Hibu failed to turn up, Wigley was peddling his merry way to see Osbourne at number 11. When we enquired through a Freedom of Information request what business the Chancellor and Wigley had, we were told it was "not in the public interest" and the request was denied.

If it was not political work, which was in the public interest, and given the proximity to the EGM, we can only assume it was about the administration of Yell/Hibu.

Maybe Wigley was calling in a favour?

We know that Wigley was ensconced with the highest levels of UK government, let's take a look at his connections with the Regulatory Bodies and Authorities.

As can be seen from the graphic above, Wigley was very well-connected with all the heads of the Government Bodies and Regulatory Authorities that absolutely refused to assist our group in any way whatsoever, despite the overwhelming evidence presented backed by professional and expert opinion. Hopefully, you will, by now, have read the evidence that we presented to the Serious Fraud Office in our evidence section. This clarifies exactly what our issues were with regard to fraud.

We can examine the 2006 Fraud Act and several sections that Wigley alone has breached, before even taking into consideration his fellow Directors.

Section 4 - Fraud by abuse of position

(1)

A person is in breach of this section if he—

(a) occupies a position in which he is expected to safeguard, or not to act against, the financial interests of another person,

Wigley certainly had the responsibility to safeguard shareholders, in fact, he publicly quoted that he would "protect shareholders interest to the greatest extent possible" He didn't do that, neither is there any evidence of any attempt to do that. He acted in direct contravention of the interests of shareholders.

(b) dishonestly abuses that position, and

Wigley was without doubt dishonestly abusing his position, the fact that he had turned a trading FTSE listed company into a shell PLC, stripped of all assets, staff, customers, and did NOT inform the market or shareholder of ANY of these actions is both dishonest and fraudulent.

(c)intends, by means of the abuse of that position—

(i) to make a gain for himself or another, or

Wigley clearly made a gain for himself in allowing this to happen. His service contract (which was with a subsidiary) was increased by £120,000 annually plus an additional £20,000 car allowance. This is just what is publicly available. Wigley never declared the gains he made on a purchase of $1 million of debt in the company, or what additional benefits he received from the lenders for eliminating the interests of shareholders.

(ii) to cause loss to another or to expose another to a risk of loss.

Through Wigley's actions and inactions, 7850 shareholders lost the entire value of their shareholdings, even at Wigley's 2009 Rights issue price of 42p per share (down 80% on historical highs) the total value of losses since Wigley took the helm was just under £1 billion.

(2)

A person may be regarded as having abused his position even though his conduct consisted of an omission rather than an act.

Wigley's fraudulent activities included both omissions and acts, from failing to advise shareholders of crucial changes within the company (effectively asset stripping) to deliberately engineering defaults so that he would benefit as a debt holder.

Section 2 - Fraud by false representation

(1)

A person is in breach of this section if he—

(a) dishonestly makes a false representation, and

(b) intends, by making the representation—

(i) to make a gain for himself or another, or

(ii) to cause loss to another or to expose another to a risk of loss.

(2)

A representation is false if—

(a) it is untrue or misleading, and

(b) the person making it knows that it is, or might be, untrue or misleading.

(3)

Representation

means any representation as to fact or law, including a representation as to the state of mind of—

(a) the person making the representation, or

b) any other person.

(4)

A representation may be express or implied.

(5)

For the purposes of this section a representation may be regarded as made if it (or anything implying it) is submitted in any form to any system or device designed to receive, convey or respond to communications (with or without human intervention).

Wigley and his fellow Directors breached every part of section 2 of the Fraud Act, this can be read in more detail in our Misleading Information page of the Evidence Section of this website.

Section 3 - Fraud by failing to disclose information

A person is in breach of this section if he—

(a) dishonestly fails to disclose to another person information which he is under a legal duty to disclose, and

(b) intends, by failing to disclose the information—

(i)to make a gain for himself or another, or

(ii)to cause loss to another or to expose another to a risk of loss.

Again, Wigley has again breached this section of the Fraud Act on several counts. Further details can be found in the Withholding Information in the evidence section.

The first question that was to be answered by Wigley at the EGM was below

a) why he caused or permitted RNS release of 15 November 2011 to state that he had bought 2,610,000 shares in the Company when his shareholding on 31 March 2012 and 11 June 2012

was stated to be 537,407 shares;

b) what happened to the 2,610,000 shares;

c) why was that event not announced to shareholders;

d) from whom did he acquire an interest in US$ 1 million of the Company’s senior debt for approximately £200,000;

e) what the nature of that interest was;

f) what has become of that interest and, if it has been disposed of or discharged, what amount Mr Wigley received from such disposal.

In his letter to shareholders, prior to the EGM recommending that we all vote to lose all of our investments, he stated;

"However, as regards the first question submitted by the Requesting Shareholders, I would like to take this opportunity to clarify the position regarding my dealings in the share capital of the Company. Although an announcement released by the Company on 15 November 2011 correctly stated that I had acquired 2,610,000

shares (which took my holding in the Company to 3,147,407 shares as at that date), unfortunately, due to a typographical error, the Annual Report for the financial year ended 31 March 2012 incorrectly stated that I held only 537,407 shares. Therefore, contrary to speculation, I have never sold any of my shares in the Company."

You will notice here that Wigley conveniently only answers one-sixth of the question, and ignores the rest that he can't or more likely won't answer, particularly with regard to his $1,000,000 purchase of company debt.

Rather than just a "typographical" error, we don't believe that, as Investor Relations at Hibu didn't know the full story some months earlier

Here is a series of emails between a shareholder and hibu Investor Relations , acknowledging the discrepancy between Wigley's reported holding as per the 2012 annual report and information provided to the market via RNS.

Note that the date of the acknowledgement of misinformation 19/07/2013. shares were not suspended until 25/07/2013 yet no attempt was made to communicate the error to the market before the suspension of shares.

From: Investor Enquiries \(UK\) Date: 7/17/2013 3:13:44 PM

To: xxxxxxx

Dear Mr

There has been no change to Bob Wigley's shareholding as per the 2012 Annual Report - he holds 537407 shares. We would have put out an RNS if he had either bought or sold any shares.

Kind regards

Investor Relations Team

www.hibu.com

From: Investor Enquiries \(UK\) Date: 7/18/2013 10:38:33 AM

To: xxxxxxx

Dear Mr

We have no idea where you got the 3,147,107 share figure from!! Bob Wigley joined as Chairman in July 2009 and, as per the extract below from the 2010 Annual Report, has always had 537,407 shares. This has not changed since 2009/2010.

Kind regards

Investor Relations Team

www.hibu.com

We questioned why Wigley then declared he had purchased additional shares and these were not shown in the annual report.

This message has high priority.

From: Merali, (surname given) \(UK\) Date: 7/18/2013 10:45:55 AM

To: xxxxxx

Apologies - just seen the RNS you are referring to and I am investigating with the Legal Team and will come back to you at the earliest.

Investor Relations Team

www.hibu.com

From: Investor Enquiries \(UK\) Date: 7/19/2013 3:45:11 PM

To: xxxxxxx

Dear Mr

Upon further investigation, there appears to be an error in the number reported in the annual report, and you are correct. Mr Wigley continues to hold 3,147,407 shares in hibu, as per the RNS announcement of 15 November 2011, and to go straight to the point of your original question, he has not divested any shares since then.

I am sorry for any confusion caused.