A True and Factual Account of Fraud and Corruption

The Orchestrated Plan

The Orchestrated Plan

This section highlights the steps that we believe were taken to defraud shareholders of their investments, going back at least to late in 2010 and continuing until the company ceased to be a plc on 17 February 2014.

We are of the view that the Board flouted their duties as Executive and Non-Executive Directors, as set out in the Companies Act 2006.

Those duties include, but are not limited to:

· A duty to exercise the powers of a director for proper purposes

· A duty to promote the success of the company

· A duty to exercise independent judgement

· A duty to exercise reasonable care, skill and diligence

· A duty to avoid conflicts of interest or conflicts of duties

Until the shares were delisted on 25 July 2013, shareholders relied upon each of the Directors of hibu to protect their interests. s172 of Companies Act 2006 (CA) requires a director to “act in the way he considers, in good faith, would be most likely to promote the success of the company for the benefit of its members”. Shareholders were let down by the directors of hibu.

The real purpose of the restructuring is described by Deloitte in their Joint Administrators’ Statement of Proposals, 14 March 2014 - “As individual subsidiaries have remained solvent and trading as a result of the Restructuring, creditors of the subsidiaries [the Lenders] and their employees [the directors] have been protected”.

The Directors had clearly been trying to ensure that the Lenders’ interests were served and that they secured themselves contracts in the new regime. In the end, it is our belief that they left without taking up their new positions due to the scrutiny they knew they were coming under as a consequence of hSG’s investigations.

Appointment of Mike Pocock as CEO

1st November 2010 RNS – on the selection of Mike Pocock to be Yell Group’s CEO, with effect from 1 January 2011.

Bob Wigley -

"Prior to Linksys, Michael was President and Chief Executive of Polaroid Corporation, which he joined in 2003, leading the recovery of the company to profitability and being instrumental in its sale to Petters Group Worldwide for $426 million in 2006."

This was a misrepresentation of the truth. In reality, Tom Petters (owner of Petters Group Worldwide) had been sentenced to 50 years in jail in April 2010 for running a $3.65 billion Ponzi scheme, including the purchase of Polaroid in 2005 with money from the scheme which helped to ‘legitimise’ his fraudulent activities. Wigley should have been fully aware of this in the course of making background checks prior to Pocock’s appointment, and Pocock was under an obligation to declare it.

The first claim against John Michael Pocock was filed on 10 October 2010 (see Case 08-45257). Wigley should have confirmed the existence of this court case against Pocock and disclosed this material fact to shareholders.

Mike Pocock had received $8,544,667 (2%) of the $426 million proceeds of the Polaroid sale, and two other Polaroid executives, Bob Gregerson $4,272,333 (1%) and Mark Payne $2,136,106 (0.5%). The number of shares held is detailed at http://openinsider.com/POHC, and information that the issuer paid $12.08 per share is detailed at http://www.sec.gov/Archives/edgar/data/1227728/000117911005008391/xslF345X03/edgar.xml).

Pocock and Gregerson were both cited in subsequent Minnesota legal claims relating to the Petters’ fraud (see Appendix - Michael Pocock’s US Citations and Bob Gregerson’s US Citations), in an attempt to recover some of the monies – and both were subsequently in charge (along with Mark Payne) of the ‘restructuring’ that took place at hibu (see next section).

Pocock had also been in charge of a series of major corporate ‘restructuring’ exercises or asset sales at Cisco (Linksys), Compaq, Hewlett Packard and Digital Equipment Corporation prior to taking up his role at Yell Group plc.

Recruitment of Mike Pocock’s ‘senior management team’ in 2011

· 15 February 2011 RNS - Mark Payne was appointed as Chief Operating Officer.

· 14 July 2011 RNS - Bob Gregerson was appointed as Chief Consumer Officer.

· 14 July 2011 RNS - Chris Landry was appointed as Head of Brand and Design.

It had taken just 6 months for Pocock to recruit three prominent members of his familiar ‘restructuring team’ to entirely new and very senior management positions at Yell. It gave him complete operational control and minimised the impact of potential dissenting voices.

All three had worked under Mike Pocock on major ‘restructuring’ exercises at Polaroid, Cisco-Linksys and Compaq; and Gregerson and Landry had done so at Hewlett-Packard and Digital Equipment Corporation as well. But their extremely close links were never highlighted.

Had hibu shareholders been informed of the closeness of the ‘connection’, they would have been forewarned of the events that would inevitably follow.

The career histories of Payne, Gregerson and Landry contain evidence that, whenever Pocock took up a senior role at a large company, they immediately left their existing positions to join him, regardless of the seniority of the positions they currently held. All also left hibu in March 2014 (together with Pocock) immediately after the ‘restructuring’ was complete.

See supporting article, http://www.theguardian.com/business/2011/jul/14/yell-michael-pocock-bank-debts-emarketplaces.

26 July 2012 RNS - Yell was renamed hibu at the AGM, with the new name taking effect on 30 July 2012. (RES15 filing)

This change entailed ditching the well-known and popular brand name, which had given rise to a significant proportion of the company’s ‘value’, and replacing it with an eminently forgettable brand name that Pocock himself acknowledged meant absolutely nothing. The strategy served to protect the legacy brand of Yell and Yellow Pages while hibu was used as an SPV.

Spending exorbitant sums on acquisitions

Had the directors of hibu been concerned about securing the future of Yell Group plc and its investors, they would have exercised restraint in spending company funds. However, they did precisely the opposite by massively overpaying for certain acquisitions and engaging in ‘golden handcuff’ arrangements with the founder members of the acquired companies.

This leads hSG to believe that the company’s purchases, while being promoted as part of the digital transformation of the company, were in fact part of a plan to weaken the company’s balance sheet in order to facilitate the transfer of control to the Lenders.

hSG also believes that Bob Wigley hired Mike Pocock primarily to perform the task of decreasing the company’s value, while appearing to promote it, with the ultimate aim of benefiting the Directors themselves and the Lenders.

Purchases such as those mentioned below intensified the pressure on the company’s finances and potential breaches of covenants

11 July 2011 RNS – on the acquisition of Znode

“The total consideration for the acquisition is $18 million in cash paid to Znode investors, plus Yell will settle Znode's existing net debt of $1.2 million.”

The purchase of Znode caused hibu plc’s EBITDA: revenue ratio (normally around 28%) to drop dramatically for the fourth quarter of 2011, and was the start of pressure on the covenants.

In the year prior to its acquisition, Znode had achieved revenues of only $2.5 million, and it was a fledgling company of only 15 employees. This over-spend resulted in about £12.5 million (6% of what was then Yell Group’s market cap) going straight into the pockets of the owners of Znode – ‘Vish’ Vishwanathan and David Chu - who were also appointed to senior positions at Yell Connect.

The acquisition was promoted as a positive step for the company, with Pocock stating “The Znode team and their innovative technology provide Yell with a platform for our digital business and enable us to provide ecommerce solutions to small businesses… Their talented workforce and technological capabilities are a great addition to Yell as we move forward into new digital marketplace opportunities."

This however ran completely contrary to comments from staff involved with the Znode product (Glassdoor reviews (http://www.glassdoor.co.uk/Reviews/Employee-Review-Znode-RVW4023912.htm) and a technical website (http://jaysylvester.com/case-study/client/Znode/)) which revealed it was extremely unsatisfactory – “The product itself was not up to par with what the competition offered. It was not priced appropriately for the market”… “The Znode division was closed in 2013. Company was not able to keep up with e-commerce trends”, “…weighed down by years of legacy code … All the technical leads agreed this was a less than ideal foundation upon which to build a flagship product”.

The Chapter 15 Case Summary filings in the US show information about 6 hibu subsidiaries that were put into administration on 28 January 2014, http://www.bankrupt.com/TCR_Public/140130.mbx.

They include the following details for Znode:

Znode, Inc. Estimated Assets: $10 million to $50 million

Znode, Inc. Estimated Debts: more than $1 billion

A former Senior Executive at hibu (US), commented on the Board’s decision in an email to hSG – “We narrowed the field of ecommerce acquisitions then settled on Znode as one of the last ones out there. That said, it was a stupid acquisition. They paid $19m to buy it when all they had to do was pay $2.5m for the source code.”

Purchase of Moonfruit

16 May 2012 RNS – on Yell’s acquisition of Moonfruit.

“The total cash consideration for the acquisition is approximately £18 million, funded out of Yell's cash reserves. Retention bonuses of up to £5.2 million will be paid to key Moonfruit management after two years, provided that they remain exclusively employed by Yell.”

The value of the assets which were the subject of the transaction, according to Moonfruit's own balance sheet as at 31 December 2011, was £4.88 million. For the year ended 31 December 2011, Sitemaker Software Limited, Moonfruit's wholly-owned subsidiary, made a LOSS before tax of £1.26 million.

This meant that, at the same time that Yell was involved in sensitive restructuring talks with its advisers which ultimately resulted in no value whatsoever for the shares, the Board was again paying massively over the odds for a loss-making acquisition.

The Independent ran with the headline - “A London entrepreneur who was forced to sack staff at her website-making business in a bid to save money today sold it for up to £23 million”, http://www.independent.co.uk/news/business/news/windfall-for-founder-as-yell-buys-moonfruit-7758159.html.

Creating a complex web of subsidiaries

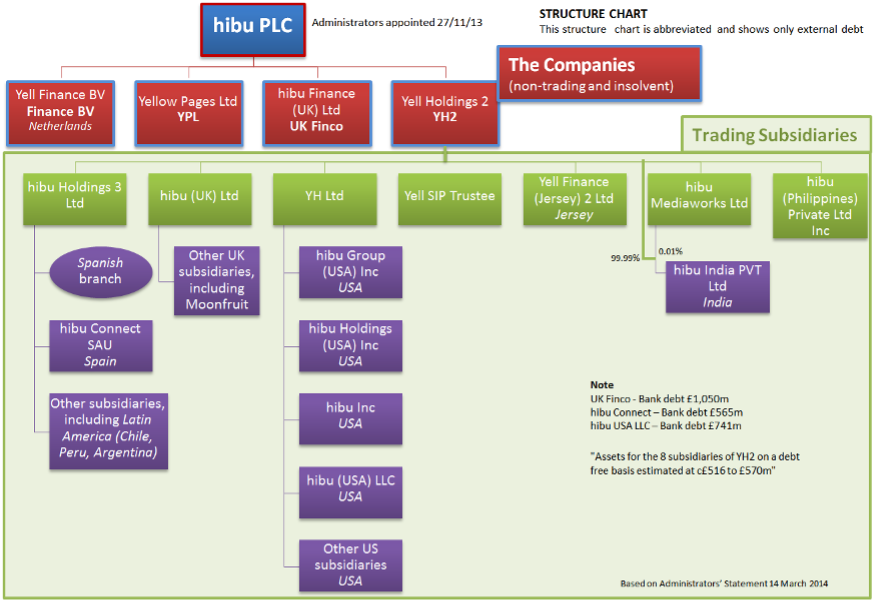

The following diagram illustrates only some of the inter-company complexity created by the Yell board in its transition to hibu and subsequent ditching of the parent company hibu plc in which shareholders were invested.

Structure Chart based upon Joint Administrators’ Statement of Proposals, 14 March 2014

The Joint Administrators’ ‘Statement of Proposals’ issued by Deloitte on 4 March 2014 states - “Assets for the 8 subsidiaries of YH2 on a debt free basis estimated at c£516 to £570m.” Assets for a holding company are its shares, intercompany receivables and tax receivables.

Moving Vast Sums of Money Around the Group Unannounced

The shareholders group spent months following the paper trail and consequently the money around the web of companies created by the Yell/Hibu directors. It followed the nine steps as detailed below:

Step One

Yell Group plc holds at least £1.065bn in cash reserve funds.

Step Two

Yell Group plc 'loans' £1.065bn to Yell Finance BV.

Step Three

28/03/2012 Yell Finance BV buys shares to value of £1.065bn in Yellow Pages Ltd, and cash moves out of hibu plc’s reach.

Step Four

28/03/2012 Yell Finance BV issues shares to value of £1.053bn to Yell Group plc.

Step Five

Now Yell Group plc owes the same amount to Yell Finance BV that it ‘loaned’ it. Directors cancel or write off the 'loan’. They do not recall it because if they or the administrators reclaim the money, it would go to Yell Finance BV.

Step Six

Administrators Deloitte state, "Yell Finance BV cannot make a repayment on its liability without first paying off the lender debt"

Step Seven

Yell Group plc, now hibu plc, no longer holds a billion pounds in spare cash, and its assets have been sufficiently reduced to allow the administration to go ahead at will.

Step Eight

hibu plc directors at hibu (UK) Ltd send letter to hibu plc on 26/11/2013, "in light of the financial position of hibu PLC and the resolutions proposed at the General Meeting, it was not in the best interests of hibu (UK) Limited (having principal regard to the interests of its creditors) to continue to provide financial support to the Company.”

Step Nine

Administrators state, "The Company is not a lender or guarantor of the £2.3bn Group debt. Notwithstanding that the Company is not required to repay the group debt, it is insolvent because it has no ability to fund its ongoing operating costs or to pay its debts as they fall due."

Further Details of the Transactions

On 28 March 2012, Yellow Pages Limited, the wholly owned subsidiary of Yell Group PLC (now hibu PLC) issued 1,065,000,000 £1 ordinary shares to Yell Finance BV for a consideration of £1.065 billion. This was paid and shows on the cash flow statement of Yellow Pages Ltd as proceeds from the issuance of ordinary shares. This was a one-off cash transaction and not an intangible asset.

On the same day, Yell Finance BV issued 12,531,070 shares of €100 each to its parent company, Yell Group Plc for a consideration of €1,253,107,000. The EUR/GBP conversion rate was 1.19 on that date, so the consideration amounts to approximately £1.053 billion.

The Yell Group Plc share price stood at 4.2p on the day of the loan, equating to a market capitalisation of only about £95 million.

hSG finds it inexplicable that a subsidiary would issue shares in itself to the parent company, in particular at a value of 11 times the market cap of the entire group.

In summary, Yell Group Plc loaned £1.065 Billion to Yell Finance BV, its 100% owned subsidiary, which in turn used this money to buy shares in Yellow Pages Ltd. Effectively, one subsidiary spent the Plc’s loan on purchasing shares in another subsidiary.

Yell Group Plc would have had the right to recall the loan, but Yell Finance BV issued shares to Yell Group plc for a similar amount which effectively locked Yell Group Plc out of the cash in the subsidiaries.

The operating costs for Yell Finance BV were also inordinately high in 2012, when compared to the historical figures:

2010 - €64,000

2011 - €69,000

2012 - €1,699,300,000

This implies that the operating costs for a subsidiary of the Plc increased by a FACTOR OF TWENTY FIVE THOUSAND in one year, yet the reason for the significant discrepancy was never revealed.

We contend that taking all the money out of the company made it ripe for administration. Coupled with the threat of shareholder-representative directors being voted in at the EGM, the directors felt it was time to call in the administrators, Deloitte.

Deloitte later wrote, “Although the shares were suspended, the directors of subsidiary companies continued to provide funding to the Company whilst restructuring negotiations continued. However, on 26 November 2013, the Company received a letter from hibu (UK) Limited stating that, in light of the financial position of hibu plc and the resolutions proposed at the General Meeting, it was not in the best interests of hibu (UK) Limited (having principal regard to the interests of its creditors) to continue to provide financial support to the Company.”

The only logical conclusion would seem to be that the actions being taken at the time were all about moving money out of the reach of shareholders. These actions were taking place at the same time as Bob Wigley was stating in the 2012 Annual Report – “The Board remains committed to maximising value for shareholders, many of whom supported the rights issue three years ago”.

Complex Loan Structure

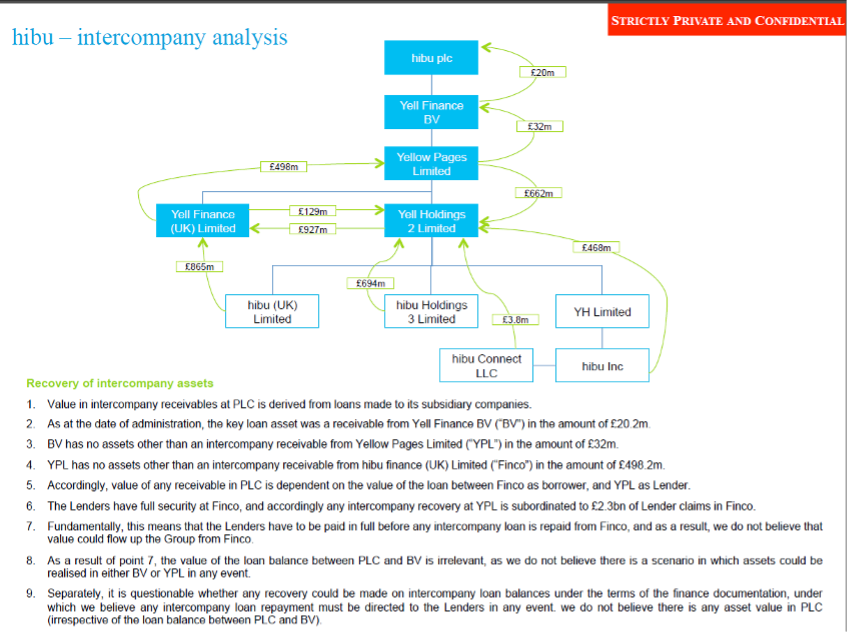

We obtained the confidential document produced by Deloitte of the complex loan structure that was created between the parent company and its subsidiaries.

While the above states - “2. As at the date of administration, the key loan asset was a receivable from Yell Finance BV (“BV”) in the amount of £20.2m” - it makes no reference to the fact that the majority of the loan had been written off before administration.

In response to questions from hSG in regard to the valuation of the group, Phil Bowers, one of the Deloitte administrators, paid scant regard to the significance of this, telling hSG simply that “the “inter-company receivables” reduction relates to a write-down of the intercompany receivable from BV from £1,024m to £13.5m.”

In effect, £1 billion was just written off without any proper explanation from either the directors or the administrators. It should be reiterated that this was not even a ‘write-down’ of the value of intangibles or goodwill – it was the movement of over £1 billion in cash, taken straight from the PLC and shareholders’ funds.

Waivers and cessation of debt repayments

The following are a series of RNSs issued by the company in relation to waivers and covenants.

· 31 August 2012 RNS - Update on restructuring process

"On 17 August 2012, hibu plc ("the Group") announced that it had approached its Lenders under its facilities agreement dated 30 November 2009 with a request to waive any possible event of default that may arise from certain repeating representations concerning the possibility of a future breach of the leverage covenant. The Group is pleased to announce that this waiver has now been obtained." The share price rose by 20% on the date of the announcement.

· 17 December 2012 RNS - Update on restructuring process

“As previously announced, hibu plc ("the Group") has approached its Lenders under its facilities agreement dated 30 November 2009 with a request for various waivers and an amendment including the ability to negotiate with the Lenders on a capital restructure. The Group is pleased to announce that this request has now been obtained.”

· 24 May 2013 RNS - Announcement

"The Group is currently in default under the 2009 Facilities Agreement. The 2009 Lenders' facility agent may, and must if directed by two-thirds of 2009 Lenders, demand immediate repayment of all amounts due. The default can only be waived by the unanimous approval of all 2009 Lenders. As this is not considered likely in the current circumstances, a waiver request for this default is not being made."

So, despite positive messages about waivers being granted, and what had been a positive market reaction, the Board of Directors decided to default within a few months on a £49 million repayment. At the time hibu plc had close to £200 million in cash and in excess of £1 billion in its network of subsidiaries.

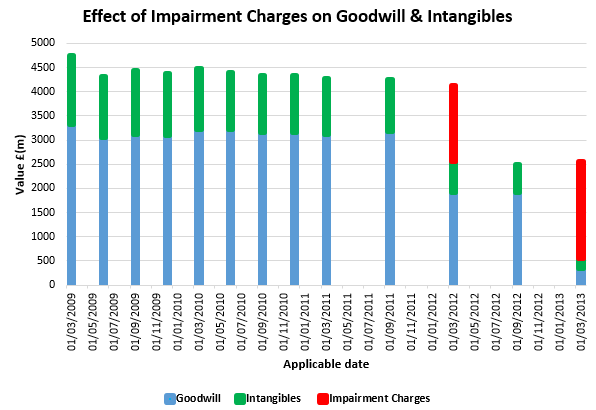

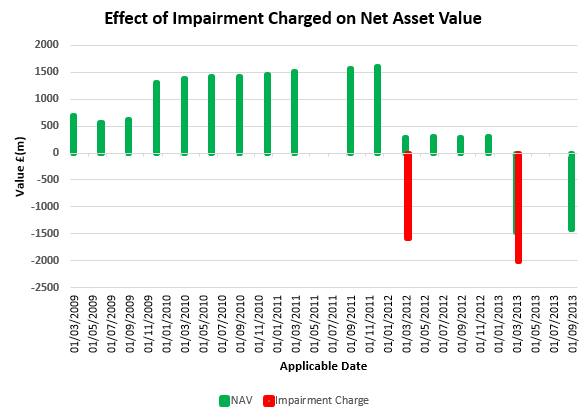

Applying huge impairment charges to Goodwill and intangibles

It is a requirement under IAS36 that the figures shown in the financial accounts for Goodwill are checked at least annually for impairment. In Yell’s case, due to the scale of the figures involved, the importance of shareholders being able to rely upon this figure in assessing the company’s true worth cannot be over-stated.

This section however highlights that, instead of a gradual adjustment to the company’s asset valuations to reflect changes in trading conditions, the company did nothing to adjust Goodwill and Intangibles for three years but then suddenly imposed huge impairment charges that caused the share price to collapse and put hibu plc directly into administration.

hSG contends that it was not therefore possible for investors in Yell/hibu to be able to determine with reasonable accuracy at any time after the refinancing of November 2009 what the company’s real financial position was and to make informed investment decisions.

· A series of Annual Reports for Yell Group plc in 2009, 2010 and 2011 stated:

"The directors are responsible for keeping proper accounting records that disclose with reasonable accuracy at any time the financial position of the Company and the Group and enable them to ensure that the financial statements and the Remuneration report comply with the Companies Act 1985 and as regards the Group financial statements, Article 4 of the IAS Regulation. They are also responsible for safeguarding the assets of the Company and the Group and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.”

Goodwill had always made up a very high percentage of the asset values for Yell/hibu, and the figure had remained much the same in 5 successive half-yearly or yearly reports from 30 September 2009 through to 30 September 2011, standing at about £3.2 billion.

However, in March 2012, the figures changed very dramatically.

· 22 May 2012 - Annual Report to 31 March 2012

Wigley: “The Group also concluded during the reporting period that it should take an impairment charge against the balance sheet carrying value of some of its businesses and so a charge of £1,802m before tax was recorded. This non-cash accounting adjustment has little effect on the businesses and simply recognises changes in current and non-current intangible assets, such as changes in goodwill and brand valuations on previous acquisitions preceding my arrival."

The ‘impairment charge’ included a reduction in the value of Goodwill of around £1.3 billion after tax and, combined with massive reductions in intangibles, led directly to a decline in the company’s Net Asset Value from £1.5 billion as stated in the 2011 Annual report to just £300 million in 2012.

Yet Bob Wigley, the Yell Chairman and a Fellow of the Institute of Chartered Accountants, was telling shareholders that it was just a “non-cash accounting adjustment” and blaming it on acquisitions preceding his arrival as Chairman, which had been in July 2009.

The 2012 annual report also referred to this as a “one-off” impairment charge, implying that it was intended to correct the previous figures given. But it was far from a ‘one-off’.

When the annual accounts were next due to be completed for the year ending 31 March 2013, the Directors were unable to get their figures agreed by the auditors PwC, so the accounts could not be issued by the expected date in May 2013.

On 25 July 2013, the hibu Directors produced their own version of the figures, showing an impairment charge of £2 billion had been applied to Goodwill and intangibles in March 2013. The Directors had it seems taken upon themselves to reject the view of auditors PwC, on the basis that PwC’s figures overstated the asset values, and were simultaneously declaring shares in hibu to be worthless.

· Joint Administrators’ Statement of Proposals, 15 January 2014:

Deloitte: “draft accounts were produced to 31 March 2013”, but “following consultation with the Company’s auditors”, the directors believed the “values attributed to assets of the Company… to be overstated…”)

With goodwill and intangibles already reduced to a total of about £550 million, an RNS on 29 October 2013 referred to “goodwill and other acquired intangible assets totalling £446m”, implying that their combined value had fallen again by another £100 million.

Having applied no impairment charges whatsoever for a period of nearly 3 years, the Board was expecting shareholders to accept a series of colossal write-downs in Goodwill and intangibles amounting to £3.6 billion in a period of just 18 months, which had reduced the value of their investments to zero, without any opportunity to challenge the numbers.

No explanation was given as to why the asset values had been written down so dramatically and in such a short space of time after a lengthy period of no change;

No explanation was given as to why hibu had been unable to agree their figures with those of their auditors and then chosen to use their own version; and

No explanation was given as to why the severity of the write-downs did not in any way appear to correlate with the much more gradual decline in the company's revenues or profitability.

The combination of these colossal write-downs in asset values and the decision to default on debt repayments was, in hSG’s opinion, designed to put the company at the mercy of its Lenders.

Not recalling loans to subsidiaries, but writing them off

· Deloitte state that Yell Holdings 2 “achieved a release of c£1.7bn intercompany payables”. This statement was made in the Joint Administrators’ Statement of Proposals, 14 March 2014, 3.3 Sale of Business.

No details are provided about which company waived the c£1.7bn payable, but the payment could only have come from hibu plc into one of its many subsidiaries.

Recalling the loan of £1.7 billion would have enabled hibu plc to purchase debt on the secondary market at around 40% of face value, in effect meaning that the entire Group debt could be paid off for around £920 million while leaving £780 million of cash in the new debt-free business.

With “profit after tax and before legacy issues” of £269 million (2012 annual report), even if the debt had been paid at face value, the outstanding debt would have been only about £500 million, or less than two years of net profit - a very manageable figure.

Not to recall this loan, in our contention, proves that the Directors deliberately engineered a situation whereby the company would be given to the Lenders. In doing so, they abused the trust of shareholders, violated their fiduciary duty, misled the market as to their true intentions and, we believe, committed FRAUD.

In Appendix 7 of this administrator’s document, the SIP16 Letter states on page 2, “The intercompany payables did not set off against the £l.8bn of intercompany receivables”, It was confirmed by the administrators that the subsidiaries had withdrawn any financial support to the plc.

It seems clear to hSG, from the financial accounts and the administrator’s statements, that the issuance of shares between subsidiaries was engineered so that, in the event of administration, there were several layers of protection between the Group PLC and the subsidiary holding over £1 billion of PLC and shareholder funds.

The ‘Schedule of Creditors of the Companies as at the date of appointment’ table on page 24 shows hibu plc writing off an amount of £20,320,000 for Yell Finance BV, ‘as at 27 February 2014’.

· Cash in the business “as at 31 January 2014 was £296m”.

That £296 million of cash could have been used to make a series of debt repayments (the first missed payment having been £49 million). Alternatively, as had happened in early 2012, it might have been used to buy back a significant amount of debt on the secondary debt market, the price of hibu debt having fallen to 18% of face value in the course of 2013.

Used prudently, hSG believes that the cash available would have allowed both the continuation of debt repayments and a substantial reduction in the amount of debt, leading in turn to lower and more manageable interest repayments being due.

However, instead the directors of hibu chose to voluntarily default on the debt repayments and took no further action to reduce the amount of outstanding debt, preferring instead to put the company into administration.

Suspension of Trading and Delisting

· 25 July 2013 – Restructuring Update

Terms had been agreed with the CoCom for restructuring of debt. £2.3 billion debt was to be replaced by £1.5 billion, thereby on the face of it writing off £800 million of debt. Shareholders were informed that they would receive no payment and their shares would have zero value. The agreement required the approval of Lenders holding 75% of debt.

In essence, the Board of hibu had given complete control of the company and any shareholder value to its Lenders in return for an agreement to “write down” the total amount of debt by about £800 million.

Notably, this announcement came precisely one year after Pocock had stated that there was only a possibility that there would be a "dilution of existing shareholders' interests" and that shareholders would be consulted regarding the re-structuring.

By utilising secondary market debt purchase, the Board of Directors could have achieved the same £800 million debt reduction by using half of the company’s available cash balance, with no need for the fees paid to a large number of professional firms offering restructuring service and supposed expertise. The fact that a highly experienced Board of Directors should have ignored this option, despite the debt buybacks in early 2012 which were lauded by the CFO Tony Bates at the time, points to what we believe was deliberate wrongdoing.

Moving the accounting reference date.

Throughout its history as a listed company, Yell Group plc had a very predictable financial events calendar. It had an accounting reference date of 31 March, so was legally required to hold an AGM each year by 30 September at the latest, when the Annual Accounts would be reviewed.

In practice, it had also always held its AGM towards the end of July on a Thursday, and the Financial Accounts were always issued about 2 months ahead (in late May) to allow ample opportunity for them to be scrutinised - well inside the legal requirements.

Indeed, this was the pattern right the way through until 2012 - when the Annual Financial Report for the year ending 31 March 2012 was issued on 22 May 2012, and the AGM took place on Thursday 26 July 2012 (when the company’s name was changed to hibu plc).

However, it was at this point that the Board demonstrated its intention to ditch the previous conventions.

When the annual accounts fell due for the year ending 31 March 2013, they would normally have been issued on or about 24 May 2013.

Instead, on that date, the company issued an RNS stating: “hibu plc would like to advise that the release of its financial information for the full year to March 2013 is now intended to be made on the same day as the announcement of the agreement on the principal terms of the capital restructuring.”

There was no hint then of the real reason the figures were being delayed, which hSG now believes was because the hibu Board had been unable to get their auditors PwC to agree with their numbers.

No further financial announcements followed until 25 July 2013, the date when the AGM would normally have been held.

On that date, the Board of hibu announced their own version of the figures (which included a £2 billion write-down of Goodwill and Intangibles), suspended trading on the London Stock Exchange, and declared the shares worthless.

By making a series of major announcements on 25 July 2013, it was apparent that the Board had no intention of facing shareholders and answering questions in relation to the extraordinary changes that had happened in the course of just one year.

The financial statement also included the following paragraphs:

“The Board of Directors has given consideration to both the implications of the share suspension and the significant effect of any financial restructuring on the future shape of the Group, including the fact that hibu plc, which is the Group's ultimate holding company, is expected to be placed into administration as part of the financial restructuring. As a consequence, the Board has concluded that it is not in the interests of either the Group or its stakeholders to publish audited accounts and issue an Annual Report that does not reflect the expected effect of the financial restructuring.

The Board of Directors of hibu has therefore today given notice to the Registrar of Companies that it is changing its accounting reference date to 30 September. As a consequence, the accounting period that commenced on 1 April 2012 will now cover the 18 months ending on 30 September 2013.”

The evidence here is that the Board of Directors was unwilling to produce accounts which could be scrutinised, or to publish an Annual Report which would have had to include detailed information about what the Board had been doing over the previous 12 months.

Shareholders were in effect to be denied any information which might throw into question the restructuring option that had been chosen, and were simply expected to accept that there would be no payment whatsoever to them while ownership of the company was passed to the Lenders.

It also meant that no details of Directors’ remuneration would ever be provided. The bonus payments made to Pocock and Bates for the year ending 31 March 2012 had been omitted from the 2012 annual report, and there were to be no Annual Reports covering the years ending 31 March 2013 and 31 March 2014.

The lack of transparency and the hibu Board of Directors’ unwillingness to subject themselves to scrutiny was extremely bewildering at the time. It is now apparent that, far from fulfilling their responsibilities towards shareholders, the hibu Board was intent on denying shareholders their legal right to have their views heard and to be given clear and unambiguous information about what had happened to their investments.

Audited accounts would have gone at least some way towards answering shareholder questions. However, the movement of the accounting reference date to 30 September 2013 and then putting hibu plc into administration on 27 November 2013 (Wigley: “a planned step in the restructuring process”) meant that hibu had managed to avoid their figures being challenged at any time since the Annual Financial report of May 2012 was issued.

It is a flagrant abuse of the authority vested in Directors of a publicly-quoted company for them to take steps to prevent scrutiny of their actions, including the unexplained write off of £3.5 billion worth of assets, and the incomprehensible purchase of shares in its own subsidiary for over £1 Billion. Such actions are a serious violation of the 2006 Companies Act.