A True and Factual Account of Fraud and Corruption

Insider Dealing and Market Manipulation

Insider Dealing and Market Manipulation

“Insider dealing can be defined as trading in organised securities markets by persons in possession of material non-public information and has been recognised as a widespread problem that is extremely difficult to eradicate” and “Moreover, it should be noted that a company could be liable for insider dealing by committing the secondary offence of encouraging another person to deal” (Dr Alexander Kern, see Appendix, Insider Dealing and Market Manipulation).

The short interval of time between when an agreement was reached between hibu directors and Lenders that shares would hold no value, as reported in the Sunday Times article, and the time when Invesco decided to dispose of their shares is minimal, and suggests strongly Invesco traded on the basis of information that was not publically released by hibu.

As well as share securities, debt securities are covered in the Criminal Justice Act 1993

(http://www.legislation.gov.uk/ukpga/1993/36/schedule/2/crossheading/debt-securities).

Under this, the purchase of Wigley’s debt in November 2011, as described in section Chairman buying both Shares and discounted Debt, at a time when the Board anticipated the appointment of Goldman Sachs and Greenhill in the spring of 2012, possibly amounted to dealing on inside and privileged information for personal gain.

Unexplained disposal of their 24% shareholding by INVESCO

Invesco had amassed a 24% shareholding (567 million) in Yell by 19 January 2011, when the share price was around 14p. So, the value of their holding at that time was in the region of £80 million.

Apart from some periodic portfolio rebalancing, Invesco continued to hold those 567 million shares until 2 September 2012, when an article appeared in the Sunday Times, written by journalist Ben Marlow.

Extract: "More than 400 banks and bond investors have started work on a contentious financial restructuring that will see a large chunk of the debts wiped out and the Lenders take over. Leading creditors — including Royal Bank of Scotland, Goldman Sachs and Deutsche Bank — are understood to be in talks to appoint Houlihan Lokey, the specialist American restructuring firm, to prepare a blueprint for a debt-for-equity swap. Shareholders are likely to be wiped out."

There was no response from hibu, but over the next few days Invesco sold their entire 24% holding in the company.

Neil Woodford, the fund manager at Invesco at the time of the delisting was one of the most successful fund managers in the UK. He managed a fund worth over £18 billion. Although his reputation these days is certainly tarnished.

Woodford had commented on 14 November 2011 - "Yell's new strategy offers real opportunity for value. Yell is building a unique position in the online market, with real potential for growth and cash generation." Yet, less than a year later, Woodford sold his entire holding in hibu at a loss of at least £75 million, netting proceeds somewhere in the region of £5 million (or 1p per share).

Invesco’s action is puzzling. hibu had issued an RNS on 31 August 2012 stating:

“On 17 August 2012, hibu plc ("the Group") announced that it had approached its Lenders under its facilities agreement dated 30 November 2009 with a request to waive any possible event of default that may arise from certain repeating representations concerning the possibility of a future breach of the leverage covenant. The Group is pleased to announce that this waiver has now been obtained.” The share price had risen 20% on the day in response.

It sounded like good news, so something must have triggered Invesco to elect to sell 567 million shares immediately afterwards.

It is extremely unlikely that one of the UK’s most successful fund managers would dispose of their 24% share of a company based simply on a newspaper article. In retrospect, it is therefore clear to us that the journalist, Ben Marlow, must have found out exactly what was happening, as had Invesco, but that the company withheld this information from the public. The only response from their Investor Relations department of hibu had been “The company does not comment on press articles".

At this point, hibu also became the most shorted share in Europe, with Tiger Global subsequently identified as the primary beneficiary.

hSG finds it hard to reach any other conclusion than that Invesco must have acted on the basis of insider information about the board’s plans to wipe out shareholders, when they sold their 24% shareholding long before the market was informed about what was happening.

It was not until 19 September 2012 (17 Days after the Sunday Times article) that the hibu Board first warned shareholders of the real risk to their investment -

“As previously stated, a number of capital structure options are being considered. While no decision has yet been made, certain options may result in a dilution of existing shareholders' interests including some options which may attribute little or no value to the Group's ordinary shares."

Then, in an RNS dated 25 October 2012, Mike Pocock stated - “…a number of capital structure options are being considered. The Group can confirm that the options being considered are likely to result in little or no value being attributed to the Group’s ordinary shares…”

By not delisting when they first knew became aware that hibu shares would have zero value, hSG believes that the Directors created a false market in the shares and are guilty of a dereliction of duty towards their shareholders.

Hibu shares continued to be traded until 25 July 2013.

The $15 billion New York hedge fund, Tiger Global, was the beneficial entity behind a fund called Fresco SRL, and appears to have been far more certain than the rest of the market about the eventual outcome of the restructuring, having amassed a 12.17% ‘short’ holding in hibu by 1 November 2012.

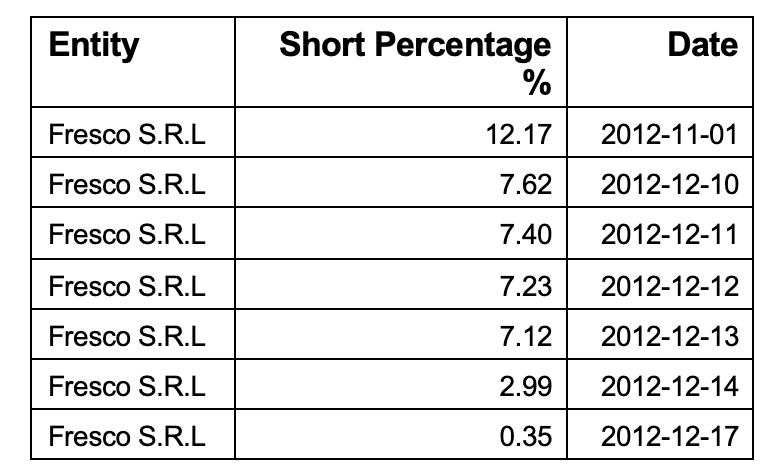

It is thought that Fresco had in fact acquired their 12% ‘short’ holding by the end of September 2012, but the only figures publicly available are as follows:

12.17% of hibu shares was approximately 280 million shares, and ‘shorting’ of course carries with it almost unlimited risk. A favourable announcement (for example that shareholders were to retain some stake in the company after all the restructuring options had been reviewed) would have seen the share price rise rapidly and significantly, making it extremely expensive for Fresco to close their shorts.

hSG considers it a reasonable conclusion that Tiger Global was somehow convinced that this would not happen.

According to the Financial Times, Tiger Global has been remarkably successful in taking out huge speculative bets against a number of listed companies.

http://www.ft.com/cms/s/0/39a324bc-70aa-11e4-9129-00144feabdc0.html#slide0

We believe that Tiger Global’s transactions in connection with hibu plc warrant further investigation on account of possible ‘insider dealing’, especially when considered in the light of Invesco’s also extremely unusual share sales over a similar period.