A True and Factual Account of Fraud and Corruption

Deloitte

Deloitte

At the hibu EGM of 4 December 2013, Phil Bowers (representing the Deloitte administrators) stated that Deloitte had only been appointed as administrators to hibu plc on 27 November 2013.

He admitted that another Deloitte department had been involved in providing advice to the CoCom of Lenders for a period of 6-12 months; but that a system of ‘Chinese walls’ at Deloitte meant that he would not be aware of the detail of those discussions.

Further information was then provided by Deloitte subsequent to the EGM.

· 15 January 2014 and 14 March 2014 - Joint Administrators’ Statement of Proposals documents, SIP16 Letter, Appendix 7

Bowers: “the Administrators have had no prior involvement with either the Company or the Group. For completeness, the Administrators confirm that Deloitte LLP (“Deloitte”) has been engaged by the Co-Com since 18 September 2012 to prepare an Independent Business Review and Options Analysis, in conjunction with the financial and legal advisers to the Co-Com. This review was prepared to assist the Lenders in their restructuring discussions"

A separate Deloitte team was engaged by the Group (at the instigation of the Lenders) through engagement letters dated 23 November 2012 and 18 December 2012 to advise on the tax and accounting aspects of the restructuring respectively, Given the size of the Group, there have been a number of smaller engagements between Deloitte and the Group, including IT Due Diligence. Internal Audit and employment tax advice. The Administrators had no direct involvement with any of these engagements.”

· 29 October 2009 from Reuters – Yell sets last debt deal deadline, court looms

"Where there is a diverse lending group it can be difficult to corral creditors into a deal," said Phil Bowers, a restructuring partner at accountancy firm Deloitte. Bowers said options such as a scheme of arrangement -- or, in more extreme circumstances, a company voluntary arrangement or pre-pack administration, -- can be used to encourage Lenders to back a deal. "A consensual solution is the aim but a robust 'plan B' can be useful to help such a deal come about," he said.

According to Phil Bowers ‘LinkedIn’ profile, at the time of the EGM he was also a Partner in the restructuring services department at Deloitte, which he had been in since 1993.

There is little doubt that Phil Bowers would therefore have been aware of the ‘Business review and Options Analysis’ provided by his own department for hibu in September 2012, and that he has extensive links to Yell restructuring going back at least to October 2009 when Bob Wigley was in charge of the refinancing completed in November 2009.

Shareholders at the hibu EGM queried the apparent ‘conflict of interest’ arising from Deloitte having both advised the CoCom of Lenders and then been chosen as administrator; and it was suggested that an independent administrator be appointed in addition to Deloitte to ensure impartiality.

Bowers however declined the request, claiming that there was no conflict of interest and “all ethical checks had been met”. He also agreed to meet with shareholder representatives and ensure that all concerns were addressed.

hSG contends that Phil Bowers and Deloitte were not impartial in the actions that they took subsequently, in effect rubber-stamping the administration of hibu plc despite numerous queries being raised with them which were inadequately answered. hSG also believes that Deloitte were intent on pushing through the restructuring due to the lucrative fees they earned from it.

Deloitte’s attention appears to us to have been on protecting the interests of the subsidiaries, above those of the plc for the administration they were actually appointed for. When questioned directly about their lack of interest in recovering over £1 Billion owed to hibu plc by the subsidiaries, Phil Bowers commented on 12 February 2014:

“We have not demanded the loan from BV as, given the assets and liabilities of BV and the subordination of the Company’s debt to the debt of the Lenders, we do not consider there to be any reasonable prospect of the Company recovering any part of that debt. Therefore the cost in seeking payment, whether through a demand or a winding up petition, is not justified and not in the interests of the Company’s creditors or its other stakeholders.”

hSG opine that this is simply not true. The Board of Directors, deliberately engineered a way to remove every single asset from the FTSE traded PLC (including moving theirs and the employee's contracts to a subsidiary)

Therefore, the PLC at the time of administration (and for some time before) had No Sales, No Costs, No Staff, No Directors, No Assets, and No Suppliers. All engineered by the incumbent board and their advisors. The market was NOT informed of this. ALL assets from the subsidiaries could have been recovered back to the PLC, by simply reversing the actions they had taken to make the PLC insolvent. Deloitte were absolutely aware of this, as could be seen by their intracompany mapping document provided in our evidence section.

When hSG also confronted Deloitte with a question about their apparent conflict of interest, Bowers replied:

“Deloitte LLP has robust procedures in place to identify and manage any potential conflicts of interest. This is required by our various regulators, including the Institute of Chartered Accounts of England and Wales (the “ICAEW”). We are satisfied that these have been complied with in this matter and that our appointment as administrators of the Company is entirely appropriate”

hSG finds it astonishing that Deloitte can cite regulation by the ICAEW as evidence of no conflict of interest, especially given that Neville Kahn, the senior figure among the three Deloitte administrators for hibu plc was Chairman of the ICAEW at the time the statement was made. Notably, Kahn has subsequently resigned from that post pending investigation into the conduct of three Deloitte administrators (including himself) in relation to the administration of Comet plc. Therefore, the Chairman of the Regulatory body that Deloitte worked to was actually the administrator of hibu PLC. How can that NOT be a SERIOUS conflict of interest?

Bowers confirmed at the EGM that the Board of Directors were not being paid. However, he didn't say they were being paid by hibu UK Ltd instead (which he was well aware of) and these were indeed enhanced contracts that the Directors were on as a reward for effectively making the PLC a worthless shell, even though still trading on the LSE until a week before the EGM. The Directors were paid well after the administration has been initiated, with records showing CFO Tony bates being paid until at least June 2014, some 7 months after delisting.

Deloitte's Official Statement of Proposals

All the information relating to the Hibu Administration has been removed from Deloitte's website. However, we at hSG have copies of all information and a full copy of the Statement of Proposals can be downloaded here.

Below, we extract certain points that Deloitte have made on the proposals and challenge them on a point by point basis.

Deloitte

"The Company is not a lender or guarantor of the £2.3bn Group debt. Notwithstanding that the Company is not required to repay the group debt, it is insolvent because it has no ability to fund its ongoing operating costs or to pay its debts as they fall due. The operating costs of the Company prior to appointment of Administrators are estimated to be approximately £750,000 per annum."

hSG

The only reason the PLC is insolvent is that the Board of Directors engineered it that way. Deloitte state that it was under no obligation to pay the subsidiaries debts, therefore there was no need for it to be placed in administration. When hSG initially enquired about purchasing the company from the administrators, Bowers informed us that it could be purchased for £440,000. We formed a consortium to raise this money and advised Bowers that we would like to go ahead on that basis. Bowers then conveniently found a further £4.5 million that the PLC owed to the pension fund, which priced our group out of buying the PLC out of administration. However, looking at the Statement of Proposals issued by Deloitte the final value was £750,000, and NOWHERE is the pension mentioned in the Statement of Proposals.

Deloitte

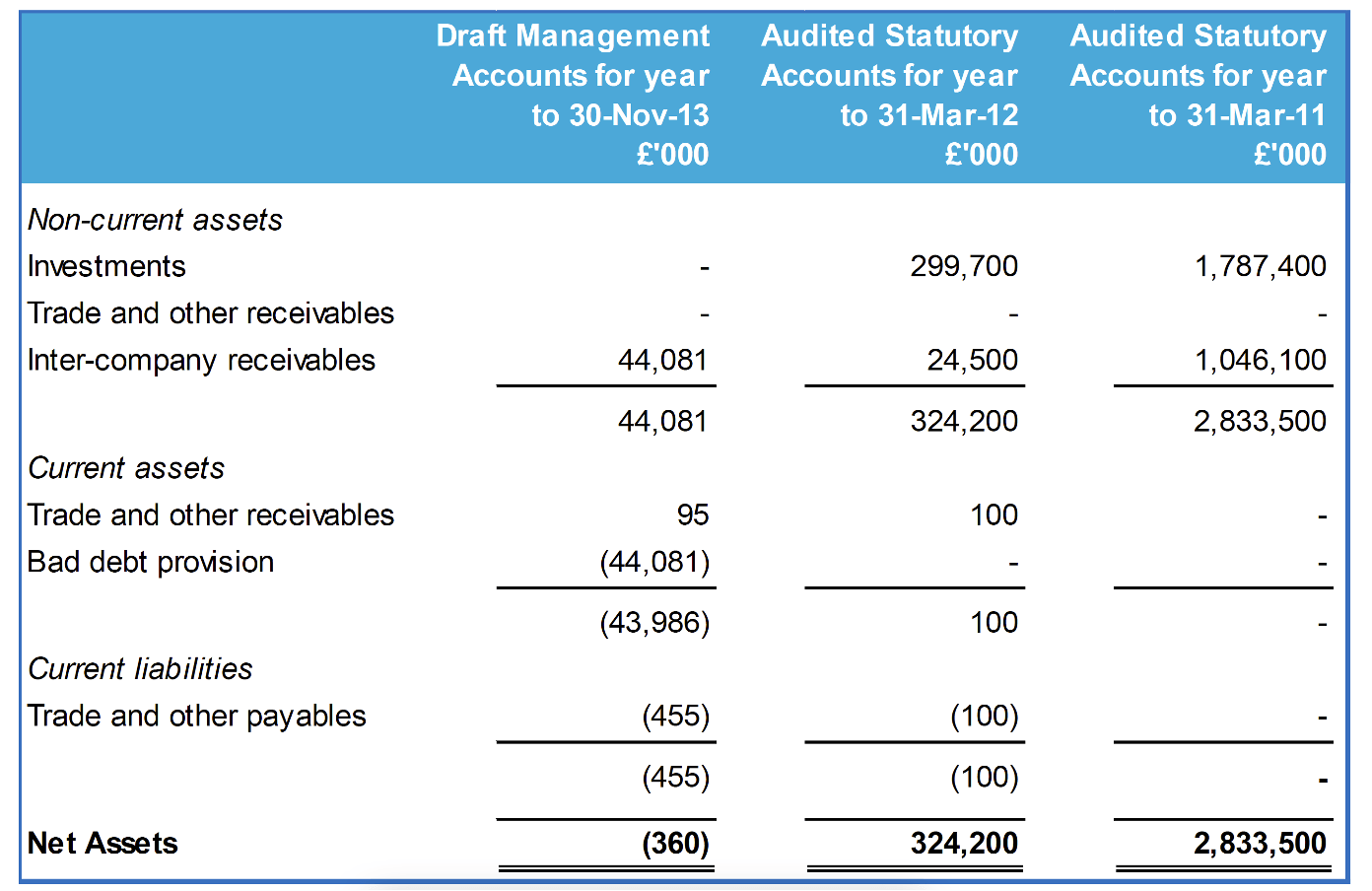

"Extracts from the audited Company accounts for the 12 months to 31 March 2011 and for the 12 months to 31 March 2012, and unaudited accounts to 31 November 2013 are shown below.

Whilst draft accounts were produced to 31 March 2013, following consultation with the Company’s auditors, the directors decided to extend the financial reporting year due to

(i) uncertainties around values attributed to assets of the Company which they believed to be overstated and

(ii) the ongoing financial restructuring negotiations which are continuing with the Group’s lenders.

Please note that the financial information summarised below has not been verified by the Administrators or by Deloitte LLP. Furthermore, the comments below each table reflect management’s explanations of the amounts included in the profit and loss account and balance sheet"

hSG

This doesn't appear to be a very thorough administration, especially as part of the administration process is to look into the Director's conduct (which Bowers specifically confirmed he would do at the EGM and in writing). However, here we see that the UNAUDITED figures, are taken as correct, and in fact the last audited accounts were covering a 12-month period that started some 32 MONTHS before administration. Also bear in mind that the Board of Directors ignored PwC's audited accounts for the next period and moved the accounting date forward by six months so that shareholders in the company did not have a true and accurate record of the companies accounts to examine during this time. Had these been made available, it would be shown that the PLC was just an empty shell company, with the Directors stripping all of its assets to syphon off into subsidiaries and away from shareholders.

Deloitte also confirm that the Directors "overstated" assets. So you have to question why, given this admission and that these items were overstated, and all the asset stripping took place during a time when shareholders were denied access to true and accurate financial records, why Bowers and his team at Deloitte did not look into the conduct of the Directors, especially as hSG has pointed out so many breaches of company law and fiduciary duty.

We can only suggest that this was because Deloitte were SEVERELY CONFLICTED, and could not operate independently and impartially, given their involvement in the previous restructuring discussions.

Deloitte also state in the proposal's Company Summary Profit and Loss Account that "The Company was a non-trading entity acting as a holding company, its costs being funded from other entities within the Group." However, at no stage were the markets informed that Hibu PLC in which shares were being traded on the London Stock Exchange was actually a non trading entity. This alone is FRAUDULENT and a MISREPRESENTATION of the truth. Deloitte conveniently did not investigate this either.

Deloitte included the below summary table in the Statement of Proposals.

Here we can see clearly the absolute wipe out of all value in the PLC over a 32-month period, from a company with an asset value of £2,833,500,000 in March 2011 to a loss of £360,000 in that period. What were the "Investments"?, they weren't goodwill, as that was shown separately. So where did over one £3 billion disappear to in that time? Deloitte made no explanation on this bar 4 very brief points at the foot of the table;

The balance sheet as at 30 November 2013 comprised:

- Inter-company receivables of £44.1m reflecting (1) £23.7m paid to purchase plc shares for an EBT scheme and (2) £20.4m receivable from Yell Finance B.V., that entity being a lender guarantor company with no assets and hence deemed irrecoverable.

- Trade and other receivables of £95,000 relates to restricted cash held for unpresented dividend cheques to shareholders and is unavailable for creditors of the Company.

- Investment value of nil, following impairments in the investment in Yell Finance BV due to impairment write-offs for goodwill and intangible assets recorded on the balance sheets of subsidiary companies in the Group.

- The trade and other payables liability comprises accruals and other payables

hSG find it astonishing that Deloitte did not investigate the conduct of the Directors, given the scale of the loss of assets over such a short period of time. Deloitte stated in the proposal;

As part of their investigations the Administrators will consider, among other matters, the following:

- statutory compliance issues;

- misfeasance or breach of duty; and

- antecedent transactions (including transactions at an under value and preferences).

hSG provided Deloitte with numerous amounts of documentation proving all of the above, such as creating a False Market, Withholding and Dissembling Information, Removal of Opposition, Directors Acting in Their Own Interests and much more. Yet despite all of this evidence being verified by independent experts such as Chartered Forensic Accountants, Lawyers and Queen's Counsel, Deloitte did absolutely nothing regarding the PROVEN misconduct of the directors.

Furthermore, we sent the below email to Phil Bowers at Deloitte on 7th February 2014, just two months after the EGM and shortly after the Statement of Proposals had been released.

"Further to a meeting with the HSG steering committee yesterday, we have agreed that we would prefer to have our questions answered in writing so that they are “on the record” and we can share these with our members.

We feel that there are many questions that remain unanswered from the EGM and as the EGM was held over two months ago we feel that these are now overdue.

I have separated the questions into two groups below and would appreciate it if you could reply to them as soon as possible.

Please could you prioritise our enquiry regarding bringing the PLC out of administration, we feel that this is of significant importance and should be the priority of an Administrator to assist in bringing a company out of administration. As previously mentioned, we feel that as shareholders of the company and being in a position to bring the PLC out of administration, this information should be conveyed to us as a matter of urgency.

I list below our questions again, I have removed the question from the administrators questions regarding the EGM minutes as our lawyer has confirmed that he and his team are still scrutinising the minutes provided by Deloittes.

As you will be aware it is now two weeks since we sent our first set of questions and to date we have not received any reply to these questions. Please could you ensure that we receive these answers as soon as possible , with priority being made to the question of HSG making an offer for the PLC.

Re-iterating my previous comments, I feel that none of these questions should be considered as confidential, and to this end the group expect that Deloitte will answer all of our questions listed below within the next seven days (bearing in mind they have already been with you for the last 14).

Should you feel that any of the questions are classed as confidential, we would appreciate it if you can advise why you consider them to be confidential and we will pass them on to the HSG team that are signed to a confidentiality agreement to take up with you.

We look forward to receiving your response within the next Seven days. As you will be well aware things are moving at a rapid pace with the Hibu restructuring and we feel that we will be disadvantaged should we not get answers to this questions within this timescale.

The group will escalate these questions should we not receive a satisfactory response by 14th February 2014.

General Questions Arising from the EGM and Other Matters

1) Please explain why administration of the PLC is being funded by subsidiaries that owe money to the PLC

2) Why have you not called in the monies owed from the subsidiaries that is owed to the PLC, thus preventing the PLC going into liquidation?

3) Please confirm that shareholders are stakeholders and therefore are legal creditors of the PLC

4) If the subsidiaries are refusing to pay the PLC then it should follow that the administrators of the PLC should place a winding up order on these companies in an effort to recoup monies held

5) We feel that the money owed to the PLC by subsidiaries when the Directors of the subsidiaries are ex PLC directors is a conflict of interest and request that they be removed from their positions in the subsidiaries.

6) Please list all of the previous dealings (when and what capacity) Deloittes has had with Yell or Hibu plc.

7) In view of your Companies recent history, how are you going to ensure that you maintain your impartiality and unbiased approach to sorting out the affairs of Hibu PLC?

8) There were two offers made for the purchase of hibu’s US operations, the highest of which was $1.9 billion, of which we have documentary evidence. Has Deloitte investigated matters associated with the offers? If you have, what’s Deloitte’s opinion? If you have not, what is the reason for not looking into it?

9) During EGM on 4th December 2013, you said that you would report investigation of sales of companies underneath hibu PLC in 6 weeks, has this report been completed? If so what is the outcome?

10) As hibu plc is the shareholder of Yell Finance B.V., what are the assets and liabilities of Yell Finance B.V.?

11) Have Neville Kahn or Ian Wormleighton been involved in any way in the restructuring talks that have been going on with hibu in recent years, prior to their appointment along with you as joint administrators?

12) Did Deloitte themselves carry out any independent checks on hibu’s financial state before accepting appointment as Administrators to hibu plc, or did they just accept the request of the Directors and unaudited accounts covering the period up to 31 March 2013?

13) Do the Administrators intend to make public information about the offers that were apparently on the table for Yellowbook USA, given that this might have entirely eliminated the need for any part of hibu to be placed into administration?

14) Do the Administrators regard it as acceptable for a company’s Directors to tell shareholders that it will put a company into administration if they perceive that members of the shareholders’ representative group might be appointed as Directors, and then to go ahead with their threat one week before an EGM to ask the existing Board some questions?

15) Why did you refuse to recognise the Directors appointed by shareholders as the new Directors of hibu plc after they had been voted in at the EGM? Surely, after only a week as Administrator you would welcome the assistance of committed individuals who clearly want to get to the bottom of the matter, and to assist in whatever way they can to assist the company out of administration.

16) Has the severe reprimand that Deloitte received last year on account of their actions as Administrators of MG Rover led to any effort to avoid potential conflicts of interest in subsequent high-profile cases?

17) In the opinion of Deloitte’s administrators, is it ‘normal’ for the Directors of a parent company, which they have put into Administration still to be employed and paid for by the subsidiaries of that parent company?

18) Please confirm whether Deloitte have considered that their role as administrator of hibu plc could in any way conflict with the services they provide to that debt holder now or in the future.

19) If you have determined there is no conflict on what basis and can you provide us in writing with your reasoning?

20) To the extent Deloitte consider there may be a potential conflict of interest between the interests of Hibu plc and such client then have Deloitte notified Hibu plc and such client of that fact in writing and requested and received a waiver to continue to act from each side in each case;

21) Have Deloitte considered whether any of the directors of Hibu plc (or any of its subsidiaries) have any interest in or relationship with a debt holder? If they have then please can they provide details of any such relationship and any perceived conflict. If they have not then why did they not consider this to be an important line of enquiry?

22) Also given the debt relationship between Hibu plc and Hibu Finance BV and the significance this had and has as to whether Hibu plc can continue as a going concern then do Deloitte consider it appropriate that they can act for both Hibu plc and Hibu Finance BV.

23) To the extent Deloitte considers there may be conflicts between its role as an administrator of Hibu plc and other services it provides, then please can Deloitte provide details of the conflict procedures it has in place and whether any of these have been breached.

24) In Deloitte's view have any of the Hibu plc debtholders exerted significant influence over the operations of Hibu or its subsidaries such that they could be considered de facto or shadow directors. If this has not been considered, then why?

25) The chairman of Hibu plc has been described as the most connected businessman in the city and it is known that the chairman has relationships with senior persons at Deloitte, including sitting with them on some advisory panels. Given these highly unusual circumstances does Deloitte consider it appropriate to act as both administrator and auditor of Hibu plc?

Administrator’s Statement Questions

1) On p2 (Background) it is stated that “the Group has £2.3 billion of debt”. We believe the exchange rate would mean this figure was now nearer £2.1 billion. For accuracy, Deloitte ought to think about adjusting their quoted figure.

2) Also on p2: “the operating costs of the company prior to appointment of Administrators are estimated to be approximately £750,000 per annum”. Deloitte need to explain how a company with no employees, that does not trade, can cost that much, especially given that Deloitte assured us at the EGM that no money would come out of hibu plc to pay the nine Directors.

3) Page 2 again: “shares in the Company will only have value if the assets are worth more than the liabilities. As there are no assets, on present information we do not believe there will be a return to shareholders. ” Presumably, that situation changes quite dramatically if the monies owed to the PLC from subsidiary companies within the group is recouped?

4) Page 3 (section 2.2) - “Whilst draft accounts were produced to 31 March 2013, following consultation with the Company’s auditors, the directors decided to extend the financial reporting year due to (i) uncertainties around values attributed to assets of the company which they believed to be overstated and (ii) the ongoing financial restructuring negotiations which are continuing with the group’s lenders.” This suggests that the Auditors had sight of some draft accounts which were due to go with the 2013 Annual report but did NOT approve them. Indeed, they have never approved them. So, why are Deloitte now happy to work from again completely UNAUDITED accounts to 30 November 2013 that the hibu directors have provided? This needs to be properly addressed.

5) Page 4: Company summary balance sheet, the whole table looks very odd. £2.83 billion of net assets in 2011, reduced to £324 million in 2012 - a difference of around £2.5 billion - and amongst it about £1 billion of “inter-company receivables” apparently gone missing.

The notes beneath the table concentrate only on the relatively small numbers, completely avoiding the large ones. Overall, it seems to suggest that large amounts were being moved around and out of hibu plc as far back as the period between 31 March 2011 and 31 March 2012, long before the official talks with the CoCom commenced in July 2012, we would welcome your clarification on this matter.

6) Page 5 (section 2.3) “The directors’ service contracts were transferred from the company to hibu (UK) Ltd (formerly Yell UK) with effect from 29 October 2012”. This is a full 8 months before shareholders were told their shares were worthless (25 July 2013), but the Directors had obviously ensured they would continue to be paid. We believe this shows that directors had put their own interests above those of shareholders would surely be evidence of serious misconduct?

7) Page 5 (section 2.4) “The group has been independently valued by a professional accounting and business firm in the last 12 months.” What accounting firm provided this valuation?, and when did that happen,? Our understanding was that the Auditors did not sign off any of the accounts on which a value might be ascribed. Also, “The valuation remains commercially sensitive as debt continues to be traded and the remaining companies in the Group remain outside of any insolvency process”. If Deloitte has been provided with a valuation for the Group, we need to know what it is so it can be scrutinised and challenged if appropriate.

8) Page 5 (section 2.5) Planned Wider Group restructuring “We understand that the terms of the restructuring have been agreed with the Co-Com and that it is planned to be implemented shortly”. This is clearly inaccurate as only 30% has supposedly agreed to the restructuring so far, and they still need 66% for it to take place. Who is telling Deloitte that the restructuring is already complete?

9) Page 6 (section 2.6) relating to EGM. “Between the meeting being convened and taking place, the Directors resolved to appoint Administrators to the Company as it was insolvent.” This contradicts the account given on p7 which states “on 26th November 2013, the Company received a letter from hibu (UK) Limited stating that, in light of the financial position of hibu plc and the resolutions proposed at the General Meeting it was not in the best interests of hibu (UK) limited (having principal regard to the interests of its creditors) to continue to provide financial support to the company”. In other words, the Directors carried out a threat previously issued to shareholders and hibu plc then became insolvent. Deloitte’s version is misleading.

10) Page 11 (section 5.6) shows that about half the £330k debt is owed to Herbert Smith Freehills (£105 k) and Linklaters (£58k). Since both were involved in the restructuring of the Group, why are their fees not being charged to whichever of the subsidiaries is currently paying for the administration?

11) Page 12 (section 6.1) says “the Administrators have agreed that all fees and expenses will be approved and paid by a third party.” Who are the third party and what do they get out of guaranteeing this payment which the document states is unlikely to exceed £200k ?

12) Page 17 shows details of Directors’ shareholdings at 11 June 2012. The strange one is Bob Wigley’s 537,407 share since it repeats the same ‘error’ that he was at pains to point out in the EGM circular to shareholders was just a typo in the Annual report to 31 March 2012. Mr Wigley claims never to have sold any of the 3,147,407 shares he had held since 15 November 2011, the date he acquired both 2,610,000 shares AND $1 million of debt. The shareholders register shows that Mr Wigley held just 537,407 shares in his own name before and on the date the shares were suspended. Please can you confirm that Deloitte are satisfied with the fact that this is just a typographical error and Mr Wigley does still own all of the shares he originally purchased."

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

So, here we have asked 37 very pertinent and important questions that should be of great interest to any administrator looking into the affairs of a company in administration, especially one as complex as this. Not one of our questions can be considered as vexatious or of having no merit. Any administrator that had completed a thorough job, would have been able to go through the questions and provide answers in a couple of hours. However, this was Bower's reply that same day.

"We have been engaging with you in a productive manner and are seeking to answer your questions to the extent we can and to the extent we consider it appropriate in the context of our duties as administrators.

The reason I suggested a meeting is that I wanted to deal with the fact pattern and any subsequent questions in an efficient manner within a small group and am of the opinion this is the most productive way forward and one where we can engage in constructive dialogue and you can obtain significantly more information. Restricting it to continued written Q&A between us will be slower, less efficient and less informative for you.

You note below that you do not consider any of the answers to the questions to be confidential and clearly this is an area I need to carefully consider. As such can you confirm what confidentiality arrangements you have in place between HSG members in respect of information they receive from you. Clearly if there is potential for information we provide to be made public by HSG members without our knowledge or consent I may need to take an altogether different approach and deal directly only with those HSG members who are signed up to confidentiality arrangements with us."

Every one of our questions we asked was appropriate in the context of their duties as an administrator, so that was another delaying tactic by Bowers. Furthermore the statement that a meeting was more appropriate and quicker is simply not true. As administrator Bowers should have had answers to all of those questions, and the reasons he wanted a meeting was so he could completely avoid the issue and questions asked (we had already attended three meetings with Deloitte, all of which were at the head office of their lawyers, Linklaters) and we knew that this certainly would not be quicker, and more efficient and informative for us. The quickest, most efficient and informative option for us would be for Bowers to just answer the questions we had.

As for confidentiality, this was the administration of a Public Limited Company, therefore NONE of the questions can be considered confidential. Moreover, the fact that the figures are based on unaudited accounts and "notes by management" means that Deloitte and Bowers should have ensured that the administration was thorough, especially with regard to the conduct of the Directors.

We can only assume that Deloitte have been less than honest in their dealings in this case. They were in severe conflict already being the advisors on the restructuring, and by refusing to allow an independent administrator to work alongside them, they did not want their administration exposed for the absolute sham it was. We openly invite Deloitte or their Lawyers to contact us on this.