A True and Factual Account of Fraud and Corruption

Withholding and Dissembling Important Information

This section sets out how the Board of Directors actively took steps to prevent shareholders from knowing the true nature of the ‘restructuring’ or having the chance to prevent ownership being wrested from them.

We believe this misrepresentation and concealment of the true facts by the directors is a breach of the following:

· s397, item (1), of the FSMA 2000, which defines market manipulation as:

(a) makes a statement, promise or forecast which he knows to be misleading, false or deceptive in a material particular;

(b) dishonestly conceals any material facts whether in connection with a statement, promise or forecast made by him or otherwise; or

(c) recklessly makes (dishonestly or otherwise) a statement, promise or forecast which is misleading, false or deceptive in a material particular.

We understand that the FSA obtained a criminal conviction under s397(1)(c) of the FSMA 2000 against a company and its directors for making a profit forecast to the market which was dependent on three contracts which did not exist (R v Rigby and Rowley (2005) (unreported). This is similar to the hibu directors giving false projections and information on products, “a budget based on nonexistent products and numbers” (see McCusker).

The US case filings in this section show that the directors were guilty on all the 3 counts above.

Further, as directors of a UK Listed company, the directors were obliged but failed to comply with the Listing Disclosure and Transparency Rules (DTR), which require the publication of quarterly financial information, and updates upon matters of importance to the market by RNS.

So, the directors were required to disclose inside information because hibu had listed shares in issue. Withholding information meant that the shareholder public was misled.

· DTR 2.2.1 states, “an issuer [hibu] must notify and RIS as soon as possible of any inside information which directly concerns the issuer unless DTR2.5.1 applies”.

· DTR 2.5.1 states, “An issuer may, under its own responsibility, delay the public disclosure of inside information such as not to prejudice its legitimate interests provided that: (1) Such omission would not be likely to mislead the public”

· By withholding information, the directors also breached S172 of Companies Act 2006, to “act in the way he considers, in good faith, would be most likely to promote the success of the company for the benefit of its members”.

Until the shares were delisted on 25 July 2013, shareholders had the right to rely upon each of the directors of hibu to perform their fiduciary duty to protect hibu plc and shareholder interests.

The directors failed to inform the markets that Yellowbook USA had been the subject of a bid on at least two separate occasions since Pocock took up the role of CEO.

· 21 June 2011 RNS – Annual Financial Report

“… to maintain or adjust the capital structure, the Group may adjust the amount of dividends paid to shareholders, return capital to shareholders, issue new shares, or sell assets to reduce debt”.

By this statement, the Board of Directors led the market to believe that they were open to selling assets. However, they had already received and rejected two offers for the US part of the business, Yellowbook Inc, and told Joe Walsh that they were no longer intent on marketing hibu US. The 2013 US case filing against Joe Walsh, 1:13-cv-03762, described the Board as terminating the process - “in or about January 2011 Walsh was informed that hibu was no longer marketing hibu US”.

The first offer was dated 6 January 2011, from New Mountain Capital LLC for “an all-cash Transaction for 100% of Yellowbook, valuing the Company between $1.6 billion and $1.9 billion.” The second offer, also dated 6 January 2011, came from Platinum Equity Advisors LLC, “on a cash-free and debt-free basis, for $1.65-$1.85 billion to be paid in cash at closing.”

A third offer was made for the company, this time by Joe Walsh, as described in the US case filing: “In or around October 2012, a year after his departure, Walsh teamed up with one of the equity firms to which he had tried to sell hibu US and, on October 24, 2012, made an offer to purchase the company. hibu did not pursue the offer.”

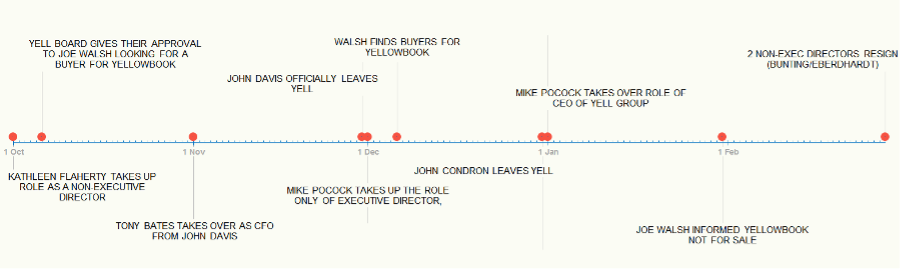

A brief timeline regarding the Yellowbook offer reveals that Mike Pocock arrived at Yell Group after Joe Walsh had been instructed to sell it, and that he would almost certainly have been central to the decision to reverse that instruction.

The Cairns lawsuit in the US (see 2.3.2) declares that “Within a month of Mr. Pocock’s appointment, the board rejected Mr. Walsh’s offer. Since [then]…, the value of hibu plc’s United States assets has dropped precipitously, to the detriment of the company and its stakeholders.” As a result, shareholders were denied the opportunity of avoiding the ruination of their investment.

Timeline showing Mike Pocock's arrival stops sale of Yellowbook

The directors failed to declare any of the offers to the market at any time. It is our contention that shareholders should have been:

1) Advised when offers were received;

2) Told when and why the sale process was then terminated.

3) Given the opportunity to vote on the offers at an EGM.

By failing to do any of these things, hSG believes that the only realistic conclusion is that the Directors were intent on withholding information from shareholders that was both price-sensitive and highly significant in relation to their investments. We also believe this to be in direct contravention to the City Code of Conduct on Takeovers and Mergers, particularly Rule 21 which states that “actions that could have the effect of frustrating a takeover bid require shareholder approval.”

The company via the administrators of hibu plc has subsequently sought to explain its failure to inform the markets as follows.

· 14 March 2014 - Joint Administrators’ Statement of Proposals

Deloitte: “The Company, in consultation with its Lenders, decided such offers did not attribute sufficient value to the business and could cause insolvency in parts of the Group not subject to those offers.”

This statement, in our view, makes no sense at all. Both offers which were exclusively for the US arm of the business, had a median level of $1.75 billion (£1.17 billion) which was approximately 4 times the then market cap of the entire business. There is no justification for the failure to announce such a material offer to shareholders and put to the vote at an EGM.

At the time of the offers, the outstanding group debt stood at around £2.4 billion and trading on the secondary market at around 40% of face value. It is reasonable to conclude that the entire debt of the group could have been eradicated, leaving a cash surplus in the region of £200 million.

Regardless of the Directors’ personal views on the relative merits of each of the offers, had they been announced they would undoubtedly have led to complete reappraisal of the company’s real worth.

The Directors’ first duty was to hibu plc. They should not have been focused on any problems that subsidiaries faced under the “financing documents” as the Plc was not a party to them. In our contention, the directors placed the interests of the subsidiaries above those of the parent company because they planned to shut down the plc and give the Lenders the accrued wealth that had been carefully dispersed to the subsidiaries.

Just before Mike Pocock became CEO on 1 January 2011, the board of Yell Group plc had included CEO John Condron, CFO John Davis, and Non-Executive Directors Joe Eberhardt and Tim Bunting. It had fully endorsed the strategy of asking Joe Walsh to seek a buyer for the US part of the business.

Condron and Davis left the company at the end of 2010 to make way for Mike Pocock and Tony Bates, as had been previously announced.

Pocock then appointed Mark Payne as Group Chief Operating Officer on 14 February 2011, a long term associate with whom he had worked very closely on a series of major corporate ‘restructurings’ including Polaroid.

Tim Bunting (then the chairman of the Remuneration committee), left the company one day later, on 15 February 2011, a departure that was announced by RNS but with no explanation given.

Joe Eberhardt, a Non-Executive Director at Yell since July 2003 and Chairman of the remuneration committee prior to Tim Bunting, then left on 28 February 2011 but his departure was not announced by RNS.

As the most senior Non-Executive Director at Yell, Eberhardt’s departure should have been announced but there was no mention of it until the 2011 Annual report (issued on 21 June 2011) which stated – “Non-executive directors Joe Eberhardt and Tim Bunting also left the Board in February 2011, to pursue their other business interests.”

The clear inference is that there must have been disharmony at Board level, possibly on a number of key issues – Pocock’s policy towards the sale of Yellowbook and the offers received for it; the remuneration policy for the new Executives and recent appointments; and the path that the company was now taking under the direction of the uncompromising Mike Pocock.

Had Joe Eberhardt’s resignation been announced in a timely fashion, coming so soon after Tim Bunting’s, it would have highlighted the serious nature of the discord and led to insightful questions being asked by astute shareholders about the relevant issues. The fact that it was not announced left shareholders completely in the dark about matters of key importance to their investment.

This is therefore yet another example of the Board of Directors flouting rules of disclosure to the stock market and withholding information that was vital to shareholders, all stemming from the point at which Mike Pocock was chosen to be CEO.

Removal of Yellowbook Executives and ensuing Litigation

The Pocock era saw a number of top level casualties and law suits. The three most senior Yellowbook executives, Joe Walsh, Jim McCusker and Mark Cairns were forced out and threatened with, or subjected to, litigation.

Pocock’s autocratic style was evident in the emails he issued to nearly 5,000 employees that publicly humiliated McCusker and Cairns before their peers. It is known from each of the case filings that when the TOP THREE Yellowbook Executives, with over 70 years’ service between them repeatedly raised their concerns, as a result of which they were asked to resign or were summarily dismissed.

· 6 March 2013 - New York Southern District Court, Case No. 1:13-cv-03762

Hibu brought a lawsuit against Joe Walsh, the former CEO and President of Yellowbook USA. Hibu accused Walsh of breaking the terms of his severance package, and of having tried to engineer a buy-out of Yellowbook USA in 2011.

There was no RNS to inform shareholders about the legal action against such a formerly high profile figure at Yell.

Jim McCusker and Mark Cairns sue the Board for Defamation

·

7 October 2014, The Pennsylvania Record newspaper article, USA, summarised the case well.

“According to the complaint, Hibu maintained its allegedly over-inflated projections for 2012, 2013 and 2014 as a way to keep the 2009 Lenders placated. McCusker and Cairns claim that they warned Pocock that the projections were fraudulently misleading, representing the strategies and acquisitions as successful endeavors.”

In January 2013, Pocock announced to senior management that the transition plan was two years behind schedule. The executives met in Texas in February for the stated purpose of revising the 2014 budget, but that never happened, McCusker says. Instead, according to McCusker, Pocock and other executives maintained that it could not start the process all over again with their 2009 investors.

The claim alleges that senior management knew that revenues could not be delivered and the projections were too high, but they could not be revised because the inflated numbers were submitted to the 2009 Lenders for the purpose of achieving a favorable restructuring of its debt.”

· This formed a breach of s993 of the Companies Act, “Offence of fraudulent trading

(1) "If any business of a company is carried on with intent to defraud creditors of the company or creditors of any other person, or for any fraudulent purpose, every person who is knowingly a party to the carrying on of the business in that manner commits an offence”.

· 3 October 2013, two cases were filed the USA:

2:14-cv-05670-NIQA - James McCusker, President and Chief Sales Office of hibu Inc, with 24 years’ service

2:14-cv-05671-NIQA - Mark Cairns was Head of Operations for U.S./UK hibu Inc, with 29 years’ service

Exhibits of McCusker and Cairns’ emails to the directors and any accompanying figures or budgetary analyses that were prepared to support their arguments to them are not in the public domain. hSG is seeking affidavits from McCusker and Cairns in support of its case.

Within both filings, numerous examples abound of directors’ “desperate misrepresentations” to invested parties. A selection of these appear below.

The McCusker case filing states, “Mr. McCusker repeatedly questioned not only the soundness but the integrity and validity of grossly inflated financial projections being communicated to the shareholders and creditors of hibu Inc.'s parent corporation, hibu plc.”

And, he complains that the ‘disloyalty’ of which he was accused related to performing his fiduciary duty by questioning “senior management's repeated misrepresentations to hibu plc's board of directors, creditors and shareholders with respect to budgeted revenue. The budgeted revenue figures were known by senior management to be unrealistic and unattainable as they were based on failed or non-existent products, initiatives, and relationships with hibu's business partners.”

In furtherance of his fiduciary duty to the company, Mr. McCusker voiced his concerns that Mr. Pocock’s digital strategies, strategic partnerships, and acquisitions were not only failing, but were being fraudulently represented to the 2009 Lenders, investors, and shareholders as successful endeavors.

For example, Mr. McCusker wrote to Mr. Bates and Mr. Gregerson on April 25, 2012 expressing his concerns about the projected Fiscal Year 2013 budget.

Mr. McCusker warned Mr. Bates and Mr. Gregerson about the risks of achieving the revenue and expense expectations in light of a budget based on nonexistent products and numbers.

Mr. McCusker assured Mr. Bates and Mr. Gregerson that both he and his team would remain committed to the Transition Strategy and its stated goals, but it needed to be based on real and tangible expenses, budgets, and revenues if it was to succeed.

Mr. Bates and Mr. Gregerson ignored Mr. McCusker’s valid concerns, and the 2013 budget was never revised.

Mr. McCusker continued to express his concerns about the impossible revenue projections that hibu plc was communicating to the CoCom as it continued to negotiate a restructuring of its debt.

McCusker asked Chris Wilcox, CFO at the Digital Division, “about the overstated revenue budget and specifically asked whether what hibu Inc. was doing was honest. Mr. Wilcox responded: “I can’t answer that.””

Mr. Pocock told management “we know revenues cannot be delivered.”

Tony Bates explained that “to submit new figures to the banks, admits digital revenue projections are too high.””

“The budgeted revenue figures were known by senior management to be unrealistic and unattainable as they were based on failed or non-existent products, initiatives, relationships with hibu’s business partners.”

Cairns

The Cairns’ case filing also categorically accuses the directors of deliberately lying to all parties, “Notwithstanding their personal knowledge of the failures for these initiatives, Mr. Pocock and hibu plc continually projected budgeted revenues for the 2012, 2013, and 2014 fiscal years which were grossly over-inflated due to the known failed partnerships, failed products and products that never reached the marketplace. They did so despite the knowledge that it was impossible to meet the stated revenue goals.”

He “questioned the company’s failure to deliver the new products claimed to be imminent throughout 2012”, puzzled, as were shareholders.

Cairns also states, “This inconsistency was raised with both Mr. Pocock and his senior team. However, questioning of Mr. Pocock’s strategy or determination was unacceptable in the culture he brought to the hibu group, as evidenced by the long line of the group’s senior leaders who exited both voluntarily and involuntarily during Mr. Pocock’s limited tenure.”

In short, the evidence from former hibu executives in the USA supports the shareholders’ contention that they were fraudulently misled by the Board. Shareholders were not advised that the transition plan was 2 years behind schedule, which revenues and projections were inflated, or that products did not really exist. It is our contention that the Directors failed to perform their fiduciary duty to inform the market of the true state of progress and affairs at the company.

We believe this misrepresentation and concealment of the true facts, by the directors, is a breach of:

· s90A of the FSMA 2000, ’Liability for false or misleading statements in certain publications’,

(3) The issuer of securities [hibu plc] to which this section applies is liable to pay compensation to a person who has—

(a) Acquired such securities issued by it, and

(b) Suffered loss in respect of them as a result of—

(i) any untrue or misleading statement in a publication to which this section applies, or

(ii) the omission from any such publication of any matter required to be included in it.”

(4) The issuer is so liable only if a person discharging managerial responsibilities within the issuer in relation to the publication—

(a) knew the statement to be untrue or misleading or was reckless as to whether it was untrue or misleading, or

(b) knew the omission to be dishonest concealment of a material fact.”

Bates was providing reports to the Lenders and to shareholders. He will have had to maintain the same story consistently across all publications to avoid alerting the Lenders to the true facts and figures. It would appear from the US filings that they misled both Lenders and shareholders, who should have been able to rely on the integrity of directors, by their false information. The McCusker and Cairns filings provide evidence that the Directors acted dishonestly, without compunction, by making false statements for the purpose of inducing or retaining debt holder and shareholder investments that would expose them to risk of loss.

Changes to the CoCom of Lenders

· 5 September 2012 RNS - Update on restructuring process

· 18 September 2012 RNS - Update on restructuring process

· 28 September 2012 RNS - 2009 Waiver Approval

· 25 October 2012 RNS - Update on capital restructuring

· 13 November 2012 RNS - Interim Results

The 5 September 2012 RNS announced that a Co-ordinating Committee (CoCom) of six Lenders had been formed to represent lender interests in the restructuring discussions.

The CoCom then consisted of Alcentra Limited, GE Corporate Finance Bank SAS, Gruss Asset Management LLP, GSO Capital Partners, QP SFM Capital Holdings Limited and The Royal Bank of Scotland plc.

In the 18 September 2012 RNS, hibu again referred to “a co-ordinating committee of six Lenders” in their restructuring update; and in the RNS dated 28 September 2012, when announcing that they had obtained some kind of waiver agreement with the 2009 Lenders, hibu stated – “The principal purpose of the waivers is to enable the Group to commence formal negotiations with the co-ordinating committee of six Lenders on the terms of a financial restructuring.”

In the 25 October 2012 RNS, hibu announced that they were suspending debt repayments and declared - “The CoCom, which holds, manages or has a beneficial interest in c.24% of the debt under the 2009 facilities agreement, has unanimously agreed to support these waivers, subject to credit committee approval.”

On 13 November 2012, in the ‘interim results’ statement RNS, the CoCom was mentioned on 9 separate occasions and there were two references stating that the “CoCom unanimously agreed”. There was no suggestion whatsoever that the composition of the CoCom had changed.

But the CoCom was not unanimous. According to Standard and Poor’s ‘LCD daily’ from 13 November 2012, the Royal Bank of Scotland plc had recently been selling down its holding of 2009 debt, which was estimated to have had a face value of £100-150 million, and had already resigned from the CoCom for undisclosed reasons.

Further, the 13 November 2012 RNS stated that “the CoCom have reached agreement on an overall timetable and next steps and, in particular, have agreed to move forward as quickly as possible to agree terms for a financial restructuring”. The deadline to vote was extended by 3 weeks from twenty two.

November 2012 to 14 December 2012.

The implication of this was that the directors of hibu were meeting some resistance to their restructuring proposal and were some way from gaining the support of holders of the required 75% of 2009 Lenders’ debt.

On 29 May 2013, a shareholder who enquired about the course of the restructuring was then told that the CoCom consisted of Alcentra, Deutsche Bank, Gruss, GSO, Soros (note that QP SFM Capital Holdings is managed by SOROS fund management) and Ares.

So, the reality was that two of the original CoCom of Lenders – RBS and GE Capital - had resigned and subsequently been replaced presumably on account of misgivings as to the nature of the restructuring. But hibu had repeatedly told the market that the CoCom was “unanimous”.

The two new members of the CoCom were confirmed in this article taken from the Daily Telegraph on 21 July 2013

http://www.telegraph.co.uk/finance/n...wner-Hibu.html, which stated - “The deal is expected to more than halve its debt, reducing it to less than £1bn, with the creditors, including Ares, Soros Fund Management and Deutsche Bank, taking control.”

A study of the RNSs issued since the creation of the CoCom of Lenders shows that, where the percentage of debt held is mentioned, it varies considerably, further evidence that the composition of the CoCom was far from stable.

· 25 October 2012 = c.24%

· 29 October 2012 = c.24%

· 25 July 2013 = 32.8%

· 29 October 2013 = 30.3%

However, not once throughout the lengthy period of restructuring negotiations did hibu mention that RBS and GE Capital had resigned from the CoCom of Lenders, or that their departure had left the door wide open for ‘vulture funds’ to buy up large quantities of discounted debt unannounced.

Assuming that RBS held £100-150 million of debt (as Standard & Poor believed), and GE Capital a similar figure, their holdings alone would have amounted to something in the region of 10% of the outstanding £2.2 billion of debt. This probably explains the increase from c24% to 32.8% when Ares and Deutsche bank assumed the positions on the CoCom previously vacated by RBS and GE capital.

Knowledge of a disagreement amongst the six original members of the CoCom would undoubtedly have had an influence on whether the restructuring option the board had chosen was approved and moved forward at the pace described in the 13 November 2012 RNS.

hSG contends that the Directors of hibu were so intent on ‘forcing through’ their choice of restructuring option quickly that they repeatedly issued misleading and incomplete statements to the market.

Their selective statements were designed to remove the resistance of uncommitted Lenders, to influence them to comply and conform to the majority decision to support the restructuring options. The removal of any residual doubt about whether there could be a common agreement removed resistance, and the directors were able to achieve the support of Lenders holding the all-important and requisite 75% of total debt. Without this dissemblance, the restructuring option chosen by the Directors would not have been accepted, and shareholder investments would not have been cancelled.

It is our contention that for an entire year, from 25 July 2012 to 25 July 2013, the hibu Directors allowed a false market in the buying and selling of hibu shares.

In May 2012, hibu had announced the appointment of Goldman Sachs and Greenhill as their advisers and, on 25 July 2012 had already embarked on a course of action to ‘restructure’ hibu plc through dissolution.

· 25 July 2012 RNS – Bob Wigley declared “the Board has decided to move proactively and engage with our stakeholders”, and Pocock stated, “A number of options are being considered and, while no decision has been made yet, certain options may result in a dilution of existing shareholders' interests."

We consider the distinction between ‘stakeholders’ and ‘shareholders’ to be extremely significant. The ‘advice’ provided by Goldman and Greenhill had resulted in a form of ‘proactivity’ that would leave shareholders without any say in the future of their company.

The Directors did not disclose to the market that they had by then already turned hibu plc into a shell holding company, with its money, staff and assets loaned or moved to subsidiaries.

Had the Directors revealed the truth, hibu plc shares would have become instantly worthless on the share trading market.

Had the directors met their duty under s656 of the Companies Act 2006, shares in hibu would not have been traded upon the premise that it had net assets. Shareholders who bought, sold or held such shares were exposed to loss in consequence of the Directors having failed in their duty under s656 of the Companies Act 2006.

By allowing company shares to continue to be traded after the decision had been made to proceed with administration, the Directors created a false market, where people bought and sold under a false impression, believing the company was being restructured for the benefit of hibu plc and would remain solvent.

We consider this to be a breach of s91 of the Financial Services Act 2012, as it amounts to market manipulation through the creation and continuation of a false or misleading impression.

Directors withhold news of deal with Lenders

· 2 September 2012 - Sunday Times Article by Ben Marlow

"More than 400 banks and bond investors have started work on a contentious financial restructuring that will see a large chunk of the debts wiped out and the Lenders take over. Leading creditors — including Royal Bank of Scotland, Goldman Sachs and Deutsche Bank — are understood to be in talks to appoint Houlihan Lokey, the specialist American restructuring firm, to prepare a blueprint for a debt-for-equity swap. Shareholders are likely to be wiped out."

The Sunday Times article accurately outlined Lenders’ plans, revealing details about their intentions for hibu and about the restructuring.

The journalist had learned what would transpire, because it was known to the Lenders and Directors at hibu plc. Even though it seems that various parties, such as Lenders, media and Invesco, an institutional investor, were aware of the deal, the directors did not advise the market by RNS.

The Directors thus withheld price-sensitive information from the market, and only released a Trading Update on 19th September, 17 days later. In this, Mike Pocock stated, “As previously stated, a number of capital structure options are being considered. While no decision has yet been made, certain options may result in a dilution of existing shareholders' interests including some options which may attribute little or no value to the Group's ordinary shares.” This was the first time the possibility of little or no value was mentioned to shareholders.

But the Sunday Times clearly knew about this possibility 17 days earlier (when the share price was 1.2p). Invesco, an institutional investor, also shed almost all its shares shortly after the Sunday Times report. They were therefore somehow convinced then that hibu shares being made worthless was imminent rather than merely possible.